Liberty Matters

-

- Mill, John E. Cairnes, and the Meaning of Aggregate Demand and Supply

- Mill, John E. Cairnes, and the Meaning of Aggregate Demand and Supply

Dr. Kates is certainly correct when he observes in his comment on, “Mill vs. Keynes on Aggregate Demand,” that “Before 1936, neither the terms, nor the underlying concepts, ‘aggregate demand ‘and ‘aggregate supply’ had any presence within mainstream economic theory.”

Dr. Kates is certainly correct when he observes in his comment on, “Mill vs. Keynes on Aggregate Demand,” that “Before 1936, neither the terms, nor the underlying concepts, ‘aggregate demand ‘and ‘aggregate supply’ had any presence within mainstream economic theory.”Yet the terms were not totally alien to economic discourse, and in one case was explained in a way that was consistent with and not antagonistic to the logic of Mill’s explanation of Say’s “Law of Markets.”

This was in a chapter in John E. Cairnes’s, Some Leading Principles of Political Economy, Newly Expounded (1874), in a chapter devoted to clarifying some aspects of the theory of “Supply and Demand.”[104]

Cairnes (1823-1875) had been a professor of political economy at Queen’s College, Galway, the University of Dublin, and at University College, London. He was well known for his detailed analysis of the gold discoveries in Australia in the 1850s, and their impact on world prices in terms of a “micro-economic” explanation of the nonneutral manner in the resulting inflationary process worked its way out around the globe in a time-sequential pattern.[105]

Cairnes argued:

The fundamental truth to be seized in connection with Supply and Demand . . . is that, conceived as aggregates, as each comprising all the facts of that kind occurring in a given community, Supply and Demand are not independent phenomena, of which either may indefinitely increase or decrease irrespective of the other, but phenomena strictly connected and mutually dependent; so strictly connected and interdependent that (excluding temporary effects and contemplating them as permanent and normal facts) neither can increase nor decrease without necessitating and implying a corresponding increase or diminution of the other. Aggregate demand can not increase or diminish without entailing a corresponding increase or diminution of aggregate supply; nor can aggregate supply undergo a change without involving a corresponding change in aggregate demand.[106]

Cairnes asks us to first conceive of circumstances under barter exchange. Once there is division of labor, the supplying of any product the production of which has been specialized in represents a demand for other commodities against which it might be traded, since there is no other way what is demanded may be obtained other than by offering so other good in exchange for it.

Once a medium of exchange – money – is introduced into the exchange process, trade becomes a transaction between seemingly two distinct sides of the market: the offering of an object representing “general purchasing power” for specific commodities (“Demand”) and the offering of specific commodities for the object representing “general purchasing power” (“Supply”).

And if we add up all that is offered on both sides of the market, aggregate Demand or aggregate Supply thus become possible ideas . . . Demand, as the desire for commodities or services seeking its end by an offer of general purchasing power; and Supply, as the desire for general purchasing power, seeking its end by an offer of specific commodities or services.[107]

As two distinct sides of the market, Cairnes says, it may seem that they can change independently of each other – a decrease or increase in Aggregate Demand separate from Aggregate Supply, and a decrease or increase in Aggregate Supply separate from Aggregate Demand.

However, assuming no increase (or decrease) in the quantity of money through which market transactions are undertaken, the only way there can be an increase in “aggregate demand” in terms of general purchasing power offered for desired commodities is first having been an increased “aggregate supply” offered for units of “general purchasing power” (money).

Or as Cairnes says:

It is true, where we have a medium of exchange, we can form the conception of general Demand as distinct from general Supply. . . . But in point of truth and fact the two things are not separable. Purchasing power, in the last resort, owes its existence to the production of a commodity, and, the conditions of industry being given, can only be increased by increasing the quantity of commodities offered for sale; that is to say, [aggregate] Demand can only be increased by increasing [aggregate] Supply. . . . This, I repeat, is fundamental in the theory of exchange; and all assumptions to the contrary must be regarded as baseless and absurd.[108]

And, likewise, if there is a decrease in the offering of goods or services in exchange for units of money (“general purchasing power”), this reciprocally decreases demand in the economy. “If a given group of laborers and capitalists produce less . . . they have, as an aggregate, less to offer for sale,” Cairnes reasoned, “and the diminution of general Supply would be exactly balanced by a corresponding diminution of general Demand.”[109]

However, what can happen, and in a world of constant change will happen, is supply and demand for particular commodities being out of balance at the specific price at which the good may be bought and sold at a moment of time. The “normal” process in such situations, Cairnes argued, was for any respective excess demand or excess supply in a particular market to bring about a change in that good’s price in the required direction to, over time, bring that market back into balance.

If there were to be a series of “excess supplies” for particular commodities at the given market prices, there could be appear to be an excess of “aggregate supply” over “aggregate demand.” But this would be only the case in that the prices of those goods in excess supply had not, yet, been lowered sufficiently to earn the “general purchasing power” (money income) that would enable the suppliers of goods in excess amount to demand more of the goods they desire on the “aggregate demand” side of the market.[110]

And, finally, a long-run increase in “aggregate demand” can only come from a long-run growth in aggregate supply, which, in turn, can only result from the necessary accumulation of capital through savings and investment to expand production, increase the productivity of labor, and bringing about a rise in the wages of labor.[111]

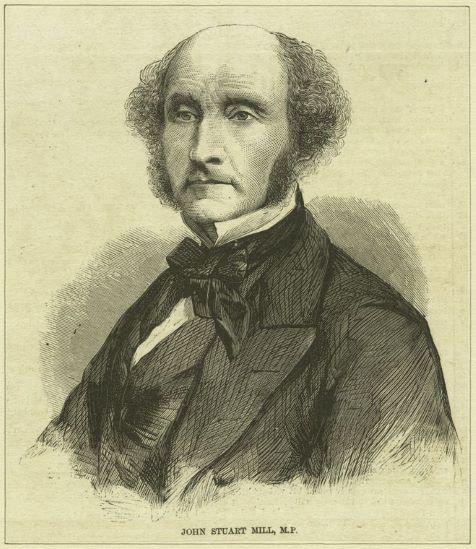

Thus, in this very, very brief summary of John E. Cairnes’s argument we find a complementary analysis to part of John Stuart Mill’s exposition (though in the form, in places in Some Leading Principles, of an immanent criticism of some of Mill’s reasoning in his Principles of Political Economy) with an explicit use of Aggregate Demand and Aggregate Supply concepts, but with implications and conclusions very different than John Maynard Keynes’s 60 years later.

Endnotes

[104.] John E. Cairnes, Some Leading Principles of Political Economy, Newly Expounded (New York: Augustus M. Kelley [1874] 1967), Chapter II, “Supply and Demand,” pp. 22-42.

[105.] John E. Cairnes, Essays on Political Economy (New York: Augustus M. Kelley [1873] 1965), pp. 1-165. Cairnes was also recognized as a major contributor to economic methodology in the late 19th century with his book The Character and Logical Method of Political Economy (New York: Augustus M. Kelley [1875; 2d ed. 1888] 1965). Online version: John Elliot Cairnes, The Character and Logical Method of Political Economy (London: Macmillan, 1875 2nd ed). </titles/282>.

[106.] Cairnes, Some Leading Principles of Political Economy, p. 23.

[107.] Ibid., p. 25

[108.] Ibid., p. 31.

[109.] Ibid., p. 33; also, p. 36: “Thus, as I have shown, it is impossible for the general demand of a community to increase or diminish save through a corresponding increase or diminution of the general supply of commodities in that community.”

[110.] Ibid., pp. 38-41.

[111.] Ibid., pp. 194-200.

Copyright and Fair Use Statement

“Liberty Matters” is the copyright of Liberty Fund, Inc. This material is put on line to further the educational goals of Liberty Fund, Inc. These essays and responses may be quoted and otherwise used under “fair use” provisions for educational and academic purposes. To reprint these essays in course booklets requires the prior permission of Liberty Fund, Inc. Please contact oll@libertyfund.org if you have any questions.