Liberty Matters

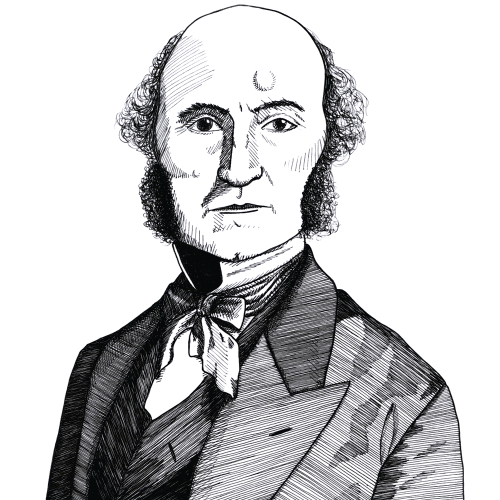

Seeing the Economy as Seen by Mill

A question I ask in class is whether a country with 10 percent growth last year has a higher standard of living than a country with 2 percent growth last year. They are all perfectly aware that the growth rate tells them nothing about living standards but cannot explain why. They cannot even tell you what was 10 percent higher.

A question I ask in class is whether a country with 10 percent growth last year has a higher standard of living than a country with 2 percent growth last year. They are all perfectly aware that the growth rate tells them nothing about living standards but cannot explain why. They cannot even tell you what was 10 percent higher.This is the vision that has been lost: the ability to see the whole economy at once, not just what has been newly produced. What is missing most of all is an explicit discussion of entrepreneurs guided by the price system producing for the market, with the profit motive ensuring value-adding activity is as high as it can possibly be.

The core aim of economic activity, so far as classical economists were concerned, was to add to the stock of productive assets and in this way to allow the economy to expand. Mistakes could be made. But the importance of profitable activity, if an enterprise was to continue absorbing the economy’s stock of capital assets and labour, was that the enterprise was continuously doing its best to use the resources at its command to produce higher levels of output that could be sold for prices higher than it had paid for its inputs.

After this, but only after this, one could look at the effect of money, which can, and often does, distort the entire process, providing false clues about where profitable activities might lie. The financial system is far from infallible, but provides an essential service in getting productive resources from those who do not wish to purchase to the full extent what their incomes will allow, and putting those resources into the hands of those who wish to purchase more than their incomes will allow.

Government spending in this vision is one more impediment to economic growth. Government for the most part is unproductive in the classical sense. Government spending almost invariably draws down on community productivity and seldom adds to it. The Keynesian belief that spending of itself drives the economy is an idea so fantastic to a classical economist that it would have been beyond belief that any such notion had ever entered into the collective heads of the profession.

The marginal revolution, with Jevons leading the way as others have noted, shifted the focus from the supply side to the demand side. There was still an appreciation of the structure of production, but it was overlaid with marginal utility as the guiding force in an economy. Jevons and many of his successors were so keen to improve the lives of the poor that they pushed redistribution to the front of the queue in thinking about the nature of economies and pushed the supply side into the background. Keynes would complete the process.

There may have been no economist, before or since, who wanted to do more for the poor and lowly paid than John Stuart Mill. But he wished to do it in the only way it has ever been possible, by deepening and broadening the capital structure of an economy. Anyone who believes that our living standards have been raised because of demand-side pressures has no idea how an economy works. It is the supply side that is all that matters, and it is only there that both wealth and jobs can and will be created.

Demand for commodities is not demand for labor. Entrepreneurial activity, driven by the search for profitable activities, is how both wealth and jobs are created. You will not find this stated in virtually any modern mainstream economics text. You can still find it elsewhere, but the best place to see it explained in full, even now, is in Mill’s Principles of Political Economy, first published though it was in the revolutionary year of 1848.

Copyright and Fair Use Statement

“Liberty Matters” is the copyright of Liberty Fund, Inc. This material is put on line to further the educational goals of Liberty Fund, Inc. These essays and responses may be quoted and otherwise used under “fair use” provisions for educational and academic purposes. To reprint these essays in course booklets requires the prior permission of Liberty Fund, Inc. Please contact oll@libertyfund.org if you have any questions.