Liberty Matters

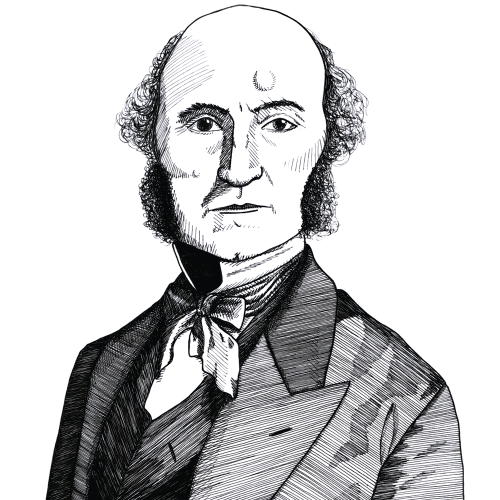

Summing Up on the Economics of John Stuart Mill

This will be my last attempt to explain my understanding of the economics of John Stuart Mill as part of this symposium. In doing so, let me say how grateful I am to the three other participants in this forum who have brought their own understanding of Mill to the table in a way that others will hopefully see how much there is to learn, not only from Mill but from pre-Keynesian economics in general. I would also wish to thank John Barkley Rosser, who from an opposite perspective took on the issues raised, which allowed us to have the most intense but for me enlightening discussion on the Coordination Problem website.[97] But mostly, I owe endless gratitude to Liberty Fund – David Hart and Sheldon Richman in particular – for allowing me this opportunity.

Let me summarize what I have been trying to explain.

And let me again put to use a production possibility curve, whose construction and conception I explained in the first of these articles. In the diagram, the interior of the production possibility curve represents the entire economy. The vertical axis shows forms of output whose production draws down on the resource base with no attempt made to replace what has been drawn down. These are described as “C and G,” which consist of forms of consumer demand and most forms of government spending. Their production uses up resources, but what is produced is not intended to contribute to production at some future date. Resources are drawn down, products are consumed or services rendered. But when all of the production is completed, the economy is less capable of producing for the future since resources have been used up during the production process, while nothing has been created to replace what has been used up.

Production Possibility Curve – Consumption, Government Spending and Investment

The horizontal axis represents all forms of drawing down on the economy’s resource base directed towards producing forms of output intended to add to the economy’s productive base. There is IC, which is the level of investment that would take place if there were only consumer demand. IC+G is an even lower level of investment spending, because here both consumers and governments deplete the economy’s resource base to satisfy their demands.

The level of saving is the proportion of the total economy that is available for maintaining the capital base as well as for new capital investment. The difference between total potential output, where the production possibility curve touches the vertical axis, and the total of consumption and government spending (C+G), is made up of the consumer goods and government services that could have been produced but were not. Saving is the productive potential left over after the economy’s resources have been used to produce goods and services bought by consumers and governments.

In a classical model, saving can occur only because of the consumer and government goods and services that could have been produced but were not. The goods and services that were not produced and purchased for current usage permitted a proportion of the economy’s existing resources to be used to maintain and extend the capital base. That saving consists of the massive proportion of the economy’s resource base that is used to build capital, roughly represented by the triangle at the top of the production possibility curve. Saving does not occur only out of current production as in a typical macro model.

Consumption to a classical economist literally meant using resources up. When Mill or Adam Smith discuss unproductive consumption, they are describing the using up of resources in ways that do not improve the future flow of output. Productive consumption, on the other hand, is the use of resources in ways that do improve the future flow of goods and services. Such consumption will include labor time, electricity consumed, machine hours taken up and everything else that was used up during their production. They were consumed in the process and are now gone. The actual workers, and much of the machinery, are still in existence, but their time and use has disappeared into whatever particular activities they were engaged in.

For myself, I find this approach clarifying, clear, and the proper basis for sound policy. Here are some of the insights highlighted by this approach bearing

- while the ultimate aim of all economic activity is to create consumer goods and services, to do so requires a vast hinterland of productive inputs which constitute overwhelmingly the largest part of the economy;

- resources are used up irrespective of whether or not what is produced is intended to be consumed in the present or to be used to increase the future flow of output;

- in a stationary economy value created is equal to the value used up;

- economic growth occurs when more value is created than is used up;

- economic activities which do not at least replace the value that has been used up cause the economy to contract;

- productive investments take time, often requiring many years before the requisite outlays are repaid in an addition to the economy’s flow of goods and services;

- productive investments are almost invariably based on entrepreneurial judgement;

- unproductive activity in the classical sense draws down on existing resources in creating utility but leaves nothing in return that can contribute to future rates of growth;

- the level of productive investment cannot be increased by increasing the level of unproductive public spending – an economy cannot be made to grow by wasting its resources;

- recessions are caused by distortions in the structure of production which occur within the interior of the production possibility curve, that is, within the interior of the economy;

- recessions may also be caused by attempts to produce more than the economy is capable of producing, leading to unexpected input shortages, bottlenecks, and increased costs;

- the most frequent but not the only cause of the distortions that lead to recession are disorders that occur within the monetary and financial system;

- a Keynesian stimulus will not only never work, it will make things worse since it will almost invariably divert resources from productive uses to unproductive;

- even worse, a Keynesian stimulus, working as it almost invariably does on the unproductive side of the economy, will create commercial pathways within the economy (a structure of production) which cause resources to be used in ways that are difficult to reverse without further economic disruption;

- national saving is made up of resources, not money;

- national saving is the use of resources to improve the underlying productivity of the economy;

- thinking of saving only as money amounts will make a sound grasp of the underlying realities impossible;

- recessions are never caused by decisions to save – both the owners of capital and the owners of labor are always keen to have the resources they own earning an income;

- allowing resources to find their best uses through adjustments in relative prices must be the single most important element of policy, not only during recessions but in every phase of the cycle;

- unemployed resources need time to find their most productive uses, which is as true for unemployed capital as it is for unemployed labor;

- there are various policies governments may adopt to hasten the adjustment process during recessions, which may even include small increases in public spending;

- business tax cuts and commercial interest-rate reductions are likely to be a useful positive approach in dealing with recession;

- the one policy governments should never adopt is to attempt to end a recession by replacing private-sector expenditure with public expenditure;

- there is no such thing as a multiplier process;

- there is no such thing as a general glut.

Endnotes

[97.] "Mill > Keynes, so says Steven Kates", posted by Peter Boettke on July 06, 2015 on Coordination Problem <http://www.coordinationproblem.org/2015/07/mill-keynes-so-says-steven-kates.html>.

Copyright and Fair Use Statement

“Liberty Matters” is the copyright of Liberty Fund, Inc. This material is put on line to further the educational goals of Liberty Fund, Inc. These essays and responses may be quoted and otherwise used under “fair use” provisions for educational and academic purposes. To reprint these essays in course booklets requires the prior permission of Liberty Fund, Inc. Please contact oll@libertyfund.org if you have any questions.