Liberty Matters

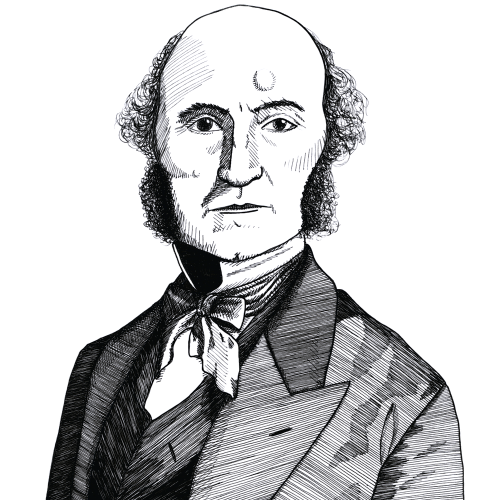

Mill vs. Keynes on Aggregate Demand

I came across Mill by accident in 1982 and was immediately convinced. I read his four fundamental propositions on capital and from that moment was no longer a Keynesian. There may be other paths to seeing the deadly flaws in modern macro, but that was mine. It is from Mill that I have derived these three conclusions:

I came across Mill by accident in 1982 and was immediately convinced. I read his four fundamental propositions on capital and from that moment was no longer a Keynesian. There may be other paths to seeing the deadly flaws in modern macro, but that was mine. It is from Mill that I have derived these three conclusions:- Recessions do occur and when they do, the effect on the labor market is prolonged and devastating.

- Recessions are not caused by oversaving and demand deficiency.

- Recessions cannot be brought to an end by trying to increase aggregate demand.

It is also a much debated question just what was revolutionary about the Keynesian Revolution. Laughably, it is now frequently said that Keynes introduced the notion of sticky wages. Apparently, Keynes’s contribution has been reduced to an argument that the adjustment process out of recession might be hampered by the failure of wages to adjust quickly enough.

It is the diagram below on the frequency of use of the terms “aggregate demand” and “aggregate supply” that shows exactly the way in which The General Theory changed the study of economics and the business cycle.

The Frequency of Use of the Terms Aggregate Demand and Aggregate Supply From 1800 to 2007

Before 1936, neither the terms, nor the underlying concepts, “aggregate demand” and “aggregate supply” had any presence within mainstream economic theory. An economist was seen as a crank even to mention any such thing – see the fate of J.A. Hobson for an instructive example.[96]

Now, at the first sign of recession, the immediate place anyone looks to for a solution is the level of aggregate demand, with policies designed to raise aggregate demand to restore full employment.

If you think variations in aggregate demand are the cause recessions, or that increases in public spending will hasten recovery, you are a Keynesian. And the sad fact is that Keynesian theory remains the near-universal belief within the mainstream of the profession, even though on every occasion Keynesian policies have been applied, including the stimulus post-Global Financial Crisis, they have miserably failed.

It is Keynesian economics that is out of date. Even though you can find aggregate demand in almost every introductory textbook in the world, as well as in virtually every macro course you might care to name, it really is time we put Keynesian theory into that famous dustbin of history. Keynesian economics has created damage everywhere it has been applied, and it is time we rid ourselves of its presence.

Endnotes

[96.] See for example, John Atkinson Hobson, The Evolution of Modern Capitalism: A Study of Machine Production. New and revised edition. (London: Walter Scott Publishing Co., 1906):

"On the contrary, if we apply a similarly graduated fall of prices to two different classes of goods, we shall observe a widely different effect in the stimulation of consumption. A reduction of fifty per cent. in the price of one class of manufactured goods may treble or quadruple the consumption, while the same reduction in another class may increase the consumption by only twenty per cent. In the former case it is probable that the ultimate effect of the machinery which has produced the fall in expenses of production and in prices will be a considerable increase in the aggregate demand for labour, while in the latter case there will be a net displacement. It is therefore impossible to argue à priori that the ultimate effect of a particular introduction of machinery must be an increased demand for labour, and that the labour displaced by the machinery will be directly or indirectly absorbed in forwarding the increased production caused by machinery." p. 320.

Copyright and Fair Use Statement

“Liberty Matters” is the copyright of Liberty Fund, Inc. This material is put on line to further the educational goals of Liberty Fund, Inc. These essays and responses may be quoted and otherwise used under “fair use” provisions for educational and academic purposes. To reprint these essays in course booklets requires the prior permission of Liberty Fund, Inc. Please contact oll@libertyfund.org if you have any questions.