Liberty Matters

The Dangers of Market Perfectionism

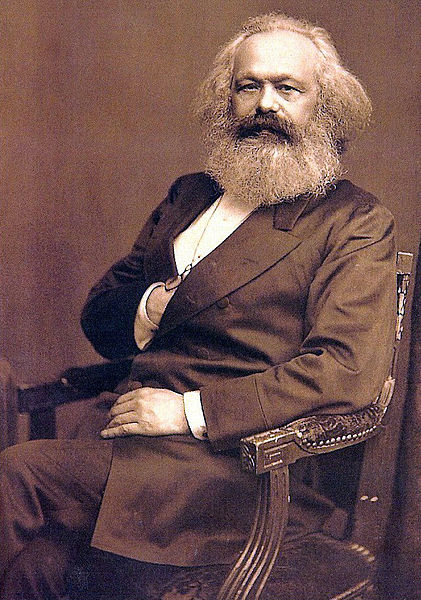

Virgil's most recent reply raises a couple of issues worthy of further explanation. In his discussion of whether exploitation is still relevant in a world that has rejected the labor theory of value, he points to a study showing that some baseball players are not paid the value of their marginal product. He asks whether it's a problem if some people in the market don't get paid what they deserve and suggests that perhaps we might want to reconsider some notion of exploitation as a result.

Virgil's most recent reply raises a couple of issues worthy of further explanation. In his discussion of whether exploitation is still relevant in a world that has rejected the labor theory of value, he points to a study showing that some baseball players are not paid the value of their marginal product. He asks whether it's a problem if some people in the market don't get paid what they deserve and suggests that perhaps we might want to reconsider some notion of exploitation as a result.His use of the word "deserve" is notable as it suggests there is an implicit ethical theory at work behind the idea that wages "should" equal the value of workers' marginal products. He's on solid ground given the role of J. B. Clark's marginal productivity theory of wage determination as a response to Marx's claim that workers are exploited under capitalism. Still, I think if we want to go in that direction as a way of taking exploitation seriously, we probably will need a full-blown ethical theory to go with it.

The baseball example does, however, raise a bigger issue. I suspect that one could go around looking for workers who aren't paid the value of their marginal product and find many at any given point in time. We could label those as examples of how capitalism does exploit workers, given some ethical theory as noted above. And in some sense perhaps they are. Here again, though, there are two questions. First, what, if anything, can be done about it? And second, do such examples of market exploitation persist?

One way to think about both questions is to ask how well markets work at correcting such examples of exploitation. That is, are studies that might find underpaid workers simply capturing a snapshot of the unfolding market process? In a more dynamic, process-oriented view of the market, we wouldn't be surprised to find errors like this; nor would we be surprised to find out that they got corrected over time. The real question is whether such exploitation, if we wish to call it that, persists despite the competitive and corrective forces of the market. Point-in-time errors of all kinds are abundant in markets. The more important question, for me, is whether those errors persist over long periods and whether any other feasible system would correct them more effectively and promptly than would markets.

This last point raises a certain danger to which friends of the market can easily succumb. Too often, defenders of markets engage in a kind of market perfectionism that makes matters too easy for the critics of markets. Whether this takes the form of more-formal "equilibrium always" theorizing or the less-formal belief that "markets will solve it," this sort of perfectionism opens the door to critics pointing to the numerous imperfections of markets as a way of showing how poorly markets actually perform. If markets are like archers, their defenders claim they will always hit the bullseye and their critics rightly point out that they rarely ever do.

Instead of asking whether markets actually reach equilibrium or can solve every problem, we should instead focus on the ways in which alternative sets of economic institutions respond to error and their capacity for self-correction. The existence of market outcomes that seem to be examples of exploitation at a point in time is not surprising. The more interesting question should be how effectively markets can recognize and correct such problems, especially as compared to alternative sets of institutions. Less important for judging markets than whether the archer always hits the bullseye is how well she adjusts when she misses. And, to extend the analogy, this is even more important in a dynamic market context where the target itself is constantly moving or perhaps, paraphrasing Buchanan (1982), only becomes visible in the very process of shooting the arrows.

In other words, we can, if we want, admit with Marx that markets will sometimes not pay people what they deserve, but also note that markets are particularly good at recognizing these situations and responding to them by closing that gap -- if, of course, we believe that to be true, as I suspect Virgil does. One of the useful things Marx can do for us is to remind us of exactly this. Markets aren't perfect, and we weaken the case for them when we pretend that they are or that they have to be.

Copyright and Fair Use Statement

“Liberty Matters” is the copyright of Liberty Fund, Inc. This material is put on line to further the educational goals of Liberty Fund, Inc. These essays and responses may be quoted and otherwise used under “fair use” provisions for educational and academic purposes. To reprint these essays in course booklets requires the prior permission of Liberty Fund, Inc. Please contact oll@libertyfund.org if you have any questions.