Liberty Matters

Classical Liberals and the Income Tax

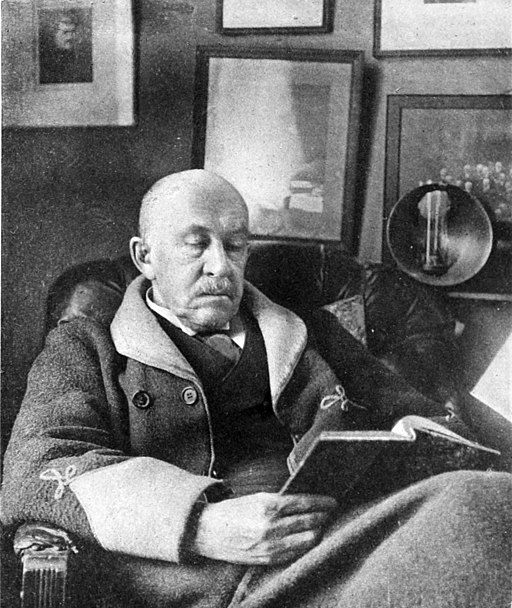

Phil Magness is correct to point out Sumner's naiveté concerning the use to which an income tax would be put by the state in the 20th century, but this was a naiveté which was shared by most classical liberals in the 19th century. Thus, I don't think he should be singled out as this blind spot concerning the voracity of the modern welfare-warfare state was I think universal as it was unimaginable to people living at that time.

Phil Magness is correct to point out Sumner's naiveté concerning the use to which an income tax would be put by the state in the 20th century, but this was a naiveté which was shared by most classical liberals in the 19th century. Thus, I don't think he should be singled out as this blind spot concerning the voracity of the modern welfare-warfare state was I think universal as it was unimaginable to people living at that time.Take for example, the case of Frédéric Bastiat. He believed that all indirect taxes fell most heavily on the poor (such as taxes on food, salt, wine) and thus wanted them abolished. Concerning tariffs, he accepted that in the absence of an income tax they were the main source of government revenue. He distinguished between a "revenue tariff" at a maximum of 5% to raise money for essential government services, and a "protectionist tariff" at anything higher than 5% which was an unjust benefit provided to powerful vested interests by the state.

However, as we will see in volume 4 of Bastiat's Collected Works, he thought there was an even fairer way to raise government revenue, namely a universal, low income tax to replace all indirect taxes and tariffs.[97] The inspiration for this was the action of Sir Robert Peel in 1842 who introduced an income tax in England in order to balance the budget and allow for a restructuring of the English tax system which did take place in 1846 with the abolition of the protectionist Corn Laws (the repeal was phased in over 4 years between 1846-49). This move, when combined with the Free Trade provisions of the Anglo-French Tariff Treaty of 1860 (signed by Richard Cobden on behalf of the British government, and Michel Chevalier on behalf of the French) introduced an unprecedented period of free trade in Europe (the U.S. as Phil Magness notes was going in the opposite direction at this time) which coincided with a rapid rise in industrial activity and increasing prosperity for western Europeans.

Assessing the average rate of tariffs in different countries is very difficult given the huge variety of products, the manner in which they were taxed (by weight, volume, or price), and whether the tariff was for "fiscal" purposes (to raise revenue for the state) or protectionist purposes (to favour domestic producers at the expense of foreign producers). A useful comparative study of tariff rates in Britain, France, Germany, Italy, and Spain in the 19th century is provided by Antonio Tena Jungito who compares average tariff rates of all goods taxed as well as average tariff rates on only protected items (leaving out the usually low rates on items taxed for fiscal purposes only).[98] From his data we can conclude the following: British aggregate tariff rates (excluding fiscal goods) peaked at about 15% in 1836 and began dropping in 1840 reaching a low point of about 6% in 1847 (the abolition of the Corn Laws was announced in January 1846 and was to come into full effect in 1849), and continuing to drop steadily throughout the rest of the century reaching a plateau of less than 1% between 1880 and 1903. France had an average rate of about 12% in 1836 and it was still around 11% in 1848 before it began to drop steadily reaching 5% in 1857, then spiking briefly to 7.5% in 1858, and dropping steadily again to about 1.5% in 1870 (the Anglo-French Free Trade Treaty was signed in 1860), before again moving steadily upwards to about 8% in 1893 (the Méline tariff was introduced in January 1892). In 1849 the rates were about 6% in Britain and 10% in France.

As a point of comparison, in the United States tariff rates fluctuated wildly as the protectionist North and the free trade South fought for control of the Federal government before the Civil War.[99] In 1832 the Protectionist Tariff imposed an average rate of 33%; the Compromise Tariff of 1833 intended to lower rates to a flat 20%; and the 1846 Tariff created 4 tariff schedules for goods which imposed 100%, 40%, 30%, or 20% depending upon the particular kind of good. The average rate in the U.S. in 1849 was about 23% which is definitely a "protectionist" tariff and not a "fiscal" tariff according to Bastiat's definition (5%).

The opposition in France to an income tax was very strong and remained strong until the eve of WW1 when Joseph Caillaux's, the French Minister of Finance, long campaign to introduce an income tax (beginning in earnest in 1907) was finally successful on 15 July 1914. Anti-income tax groups formed a Central Committee for the Study and Defence of Fiscal Matters (Comité central d'études et de défense fiscale) which organised a campaign against the income tax, which included these striking wall posters which compared state monopolies of certain industries to a large black octopus, tax inspectors and collectors to the "Inquisition," or highway robbers who ordered taxpayers to "Raise you hands!" (Hands up!) while they rifled through their personal papers.[100]

The English and French experience clearly showed that such a rebalancing of the tax burden as imagined by Bastiat and Sumner was possible and as long as public opinion favoured a system of low taxation in general the income tax remained at a low level, as in England, or, in the case of France, never introduced. However, as we well know, as soon as a Higgsian crisis appeared, most notably WW1, the ideological bedrock of upon which low taxation rested was rapidly eroded and the floodgates of steadily increasing rates of income tax were opened.

Endnotes

[97.] See for example, "Mr. Ewart's Proposal for a Single Tax in England" (Libre-Échange, 27 June, 1847) </pages/cw4#chapter-5-3351>.

[98.] Antonio Tena Jungito, "Assessing the protectionist intensity of tariffs in nineteenth-century European trade policy," in Classical Trade Protectionism 1815-1914, ed. Jean-Pierre Dormois and Pedro Lains (London: Routledge, 2005), pp. 99-120.

[99.] See, Frank Taussig, The Tariff History of the United States (New York: G.P. Putnam, 1914. 6th ed.), pp. 110-115; Douglas A. Irwin, "Tariffs and Growth in Late Nineteenth Century America," The World Economy, vol. 24(1), 2001, pp. 15-30.

[100.] Propaganda posters for the ''Comité central d'études et de défense fiscale'' contre l'impôt sur le revenu" from a collection from the Université de Caen. See "Impôt sur le revenu (France)" in the French Wikipédia <https://fr.wikipedia.org/wiki/Imp%C3%B4t_sur_le_revenu_(France)>.

Copyright and Fair Use Statement

“Liberty Matters” is the copyright of Liberty Fund, Inc. This material is put on line to further the educational goals of Liberty Fund, Inc. These essays and responses may be quoted and otherwise used under “fair use” provisions for educational and academic purposes. To reprint these essays in course booklets requires the prior permission of Liberty Fund, Inc. Please contact oll@libertyfund.org if you have any questions.