Collected Works of Bastiat, vol. 4: Miscellaneous Economic Writings

[Created: June 15, 2017]

|

|

Frédéric Bastiat (1801-1850) |

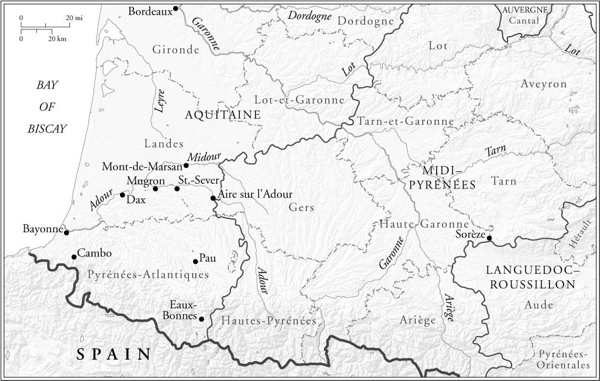

Map of Les Landes in SW France |

Introduction

We are providing in draft form volume 4 of the Collected Works of Bastiat which contains his Miscellaneous Economic Writings. Please note the following:

- this is an "Author's Final Draft" which will be tidied up and properly formatted by our in-house editor, especially things like data tables

- what we do not have here is the Front Matter and Guido Hülsmann's Introduction

- the internal references have been left blank deliberately (e.g., see, pp. 000.) as they are place-holders

- the quotes are side-by-side in French and English for research purposes. Only English quotes will apper in the final version

- we now include an Editor's Introduction to each piece

For more information about Frédéric Bastiat see the following:

- Summary of the Bastiat Project

- Works in the OLL by Frédéric Bastiat (1801-1850)

- A Reader's Guide to the Works of Frédéric Bastiat (1801-1850)

- A Chronological List of Bastiat's Writings

-

The Collected Works of Frédéric Bastiat. In Six Volumes (Indianapolis:

Liberty Fund, 2011 -2015), General Editor Jacques de Guenin. Academic Editor

Dr. David M. Hart.

- Vol. 1: The Man and the Statesman. The Correspondence and Articles on Politics (March 2011) - published book version

- Vol. 2: "The Law," "The State," and Other Political Writings, 1843-1850 (June 2012) - published book version

- Vol. 3: Economic Sophisms and "What is Seen and What is Not Seen" (March, 2017) - published book version

- Vol. 4: Miscellaneous Works on Economics (June 2017) - final draft version

- Vol. 5: Economic Harmonies (February 2019) - final draft version

- Vol. 6: The Struggle Against Protectionism: The English and French Free-Trade Movements (forthcoming)

Table of Contents

-

Some Additional Letters (7)

- Source

- Editor's Introduction

- Letter 209 to M. Muiron (Eaux-Bonnes, 7 Nov. 1844)

- Letter 216 to Félix Coudroy (1845)

- Letter 210 to Paillottet (Pisa, 30 Sept. 1850)

- Letter 211 to Paillottet (Pisa, 7 Oct. 1850)

- Letter 212 to Paillottet (Pisa, 11 Oct. 1850)

- Letter 213 to M. Soustra (Pisa, 12 Oct. 1850)

- Letter 214 to Paillottet (Rome, 8 Nov. 1850)

- Early Writings: The Bayonne and Mugron Years, 1819-1844

- Section Introduction

- T.296 (before 1830) "On the Romans as Plundering Villains"

- T.297 (before 1830) "On the Romans and Self-sacrifice"

- T.289 "The Poetry of Civilization" (c. 1830)

- T.104 "Letter to M. Saulnier, Editor of La Revue britannique, (on the cost of government in the U.S. and France)" (c. 1831)

- T.318 "Election Manifesto" (c. 1832)

- T.285 "On Certainty" (c. 1833)

- T.4 "On a Petition in Support of Polish Refugees" (c. 1834)

- T.6 "A Letter to "Charles" in Support of a Polish Refugee" (Mugron, 1 Sept. 1835)

- T.7 Five Articles on "The Canal beside the Adour" (18 June 1837, La Chalosse)

- T.286 "Proposals for an Association of Wine Producers" (15 Jan. 1841)

- T.298 (1843) "On the Cost of Being Governed"

- T.17 "On the Allocation of the Land Tax in the Department of Les Landes" (July 1844)

- T.18 "Two Articles on Postal Reform I" (3-6 Aug. 1844, Sentinelle des Pyrénées)

- The "Paris" Writings I: Bastiat and the Free Trade Movement (Oct. 1844 - Feb. 1848)

- T.23 "Letter from an Economist to M. de Lamartine. On the occasion of his article entitled: The Right to a Job" (Feb. 1845, JDE)

- T.317 "Introduction and Post Script to Economic Sophisms" (March 1845)

- T.20 "On the Book by M. Dunoyer. On The Liberty of Working" (May, 1845)

- T.47 "Thoughts on Sharecropping" (15 Feb. 1846, JDE)

- T.51 "The Theory of Profit" (26 Feb. 1846, Mem. bord.)

- T.58 & T.49 "Two Articles on Postal Reform II" (April 1846, Mem. bord.)

- T.64 "On Competition" (JDE, May 1846)

- T.68 "On the Redistribution of Wealth by M. Vidal" (15 June 1846, JDE)

- T.288 "A Light-Hearted Look at Free Trade" (mid or late 1846)

- T.80 "Second Letter to M. de Lamartine (on price controls on food)" (Oct. 1846, JDE)

- T.81 "On Population" (JDE, 15 Oct. 1846)

- T.105 "To M. de Noailles in the Chamber of Peers (on Perfidious Albion)" (24 Jan. 1847, LE)

- T.111 "A Curious Economic Phenomenon. Financial Reform in England" (21 Feb. 1847, LE)

- T.118 "Two Methods of Equalizing Taxes" (4 April 1847, LE)

- T.136 "The Salt Tax" (20 June 1847, LE)

- T.139 "Mr. Ewart's Proposal for a Single Tax in England" (LE, 27 June, 1847)

- T.143 "On Mignet's Eulogy of M. Charles Comte" (11 July 1847, LE)

- T.151 "A Letter (to Hippolyte Castille) (on intellectual property)" (9 Sept. 1847, Travail Intel.)

- T.299 (late 1847) "The Difference between doing Business and an Act of Charity"

- T.300 (1847.11.28) "On the Difference between Illegal and Immoral Acts" (LE, 28 Nov. 1847)

- T.161 "On the Export of Gold Bullion" (LE, 12 Dec. 1847)

- T.163 "A Speech on intellectual property given to the Publishers Circle" (16 Dec. 1847, Travail int.)

- T.167 "Barataria" (c. 1848)

- T.176 "Natural and Artificial Organisation" (JDE, 15 Jan., 1848)

- T.177 "Laziness and Trade Restrictions" (16 Jan. 1848, LE)

- T.178 "Letter to M. Jobard (on intellectual property)" (22 Jan. 1848, Ec. belge)

- The "Paris" Writings II: Bastiat the Politician, Anti-Socialist, and Economist (Feb. 1848 - Dec. 1850)

- Section Introduction

- T.293 (post-1848) "On Experience and Responsibility"

- T.295 (c. 1848) "Why our Finances are in a Mess"

- T.186 "A Few Words about the Title of our Journal: La République française" (26 Feb. 1848, RF)

- T.302 "Speaks in a Discussion in the Assembly on the Formation of Committees" (13 May 1848)

- T.303 "Speaks in a Discussion of Randoing 's Proposal to increase Export Subsidies on Woollen Cloth" (9 June 1848)

- T.216 "A Hoax" (15 June 1848, JB)

- T.217 "Taking Five and Returning (giving back) Four is not Giving" (15 June 1848, JB)

- T.218 "A Dreadful Escalation" (20 June 1848, JB)

- T.304 "Speaks in a Discussion on the Decree concerning the Regulation of the Political Clubs" (26 July 1848)

- T.203 (1848.07.28) "A Complaint made by M. Considerant and F. Bastiat's Reply."

- T.305 "Report to the Assembly from the Finance Committee concerning a Grant to assist needy citizens in the Department of la Seine" (9 August 1848)

- T.306 "Additional Comments in the Assembly on the Report from the Finance Committee concerning a Grant to assist needy citizens in the Department of la Seine" (10 August 1848)

- T.307 "Speech in the Assembly on Postal Reform" (24 August 1848)

- T.223 "Economic Harmonies: I, II, and III. The Needs of Man" (1 Sept., 1848, JDE)

- T.224 Bastiat's Letter to Garnier on the Right to a Job (Oct, 1848)

- T.273 "Comments at a Meeting of the Political Economy Society on Income Tax" (10 Oct., 1848)

- T.308 "Speaks in a Discussion in the Assembly on the Election of the President of the Republic" (27 Oct. 1848)

- T.274 "Comments at a Meeting of the Political Economy Society on the Emancipation of the Colonies" (10 Dec. 1848)

- T.225 "Economic Harmonies IV" (JDE, 15 Dec. 1848)

- T.294 "On the Value of Services" (c.1849-50)

- T.316 "Money and the Mutuality of Services" (c. 1849)

- T??? "The Consequences of the Reduction in the Salt Tax" (JDD, 1 Jan. 1849)

- T.309 "Speaks in a Discussion in the Assembly on a Proposal to change the Tariff on imported Salt" (11 Jan. 1849)

- T.234 Capital and Rent (Feb. 1849)

- T.275 "Comments at a Meeting of the Political Economy Society on Financial Reform" (10 Feb. 1849)

- T.310 "Speaks in a Discussion in the Assembly on Amending the Electoral Law" (26 Feb. 1849)

- T.311 "Speech in the Assembly on Amending the Electoral Law (Third Reading)" (10 and 13 March 1849)

- T.239 Damned Money! (April 1849, JDE)

- T.276 "Comments at a Meeting of the Political Economy Society on the Peace Congress and State support for an Experimental Socialist Community" (10 May 1849)

- T.230 "Capital" (mid-1849, Almanac rép.)

- T.290 "When extremes meet" (June 1849)

- T.240 and T. 283 Speech on "Disarmament, Taxes, and the Influence of Political Economy on the Peace Movement." (22 Aug. 1849)

- T.312 "Speaks in a Discussion in the Assembly on changing the Law on the Appropriation of Private Property for Public Use" (6 Oct. 1849)

- T.277 "Comments at a Meeting of the Political Economy Society on the Limits to the Functions of the State (Part 1) and Molinari's Book" (10 Oct. 1849)

-

T.241 Free Credit (Oct. 1849 - March 1850, Voix du peuple)

- Letter No. 1: F. C. Chevé to F. Bastiat (22 October 1849)

- Proudhon's Preface to Bastiat's First Letter

- Letter No. 2: F. Bastiat to the Editor (12 November 1849)

- Letter No. 3: P. J. Proudhon to F. Bastiat (19 November 1849)

- Letter No. 4: F. Bastiat to P. J. Proudhon (26 November 1849)

- Letter No. 5: P. J. Proudhon to F. Bastiat (3 December 1849)

- Letter No. 6: F. Bastiat to P. J. Proudhon (10 December 1849)

- Letter No. 7: P. J. Proudhon to F. Bastiat (17 December 1849)

- Letter No. 8 : F. Bastiat to P. J. Proudhon (24 December 1849)

- Long footnote from Letter 8

- Letter No. 9: P. J. Proudhon to F. Bastiat (31 December 1849)

- Letter No. 10: F. Bastiat to P. J. Proudhon (6 January 1850)

- Letter No. 11: P. J. Proudhon to F. Bastiat (21 January 1850)

- Letter No. 12: F. Bastiat to P. J. Proudhon (4 February 1850)

- Letter No. 13: P. J. Proudhon to F. Bastiat (11 February 1850)

- Letter No. 14: F. Bastiat to P. J. Proudhon (7 March 1850)

- T.242 "Comments at a Meeting of the Political Economy Society on Disarmament and the English Peace Movement" (10 Nov. 1849)

- T.319 "Speaks in the Assembly on the Right to Form Unions" (16 Nov. 1849)

- T.245 "Comments at a Meeting of the Political Economy Society on State Support for popularising Political Economy, his idea of Land Rent in Economic Harmonies, the Tax on Alcohol, and Socialism" (10 Dec. 1849)

- T.168 "Liberty, Equality" (c. 1850)

- T.301 "On coerced Charity" (c. 1850)

- T.315 "The Consequences of an Action" (c. 1850)

- T.182 "Our Abilities vs. Our Needs" (c. 1850)

- T.284 "A Note on Economic and Social Harmonies" (c. early 1850)

- T.250 "Comments at a Meeting of the Political Economy Society on the Limit to the Functions of the State" (Part 2)" (10 Jan. 1850)

- T.313 "Speaks in a Discussion in the Assembly on Public Education" (6 Feb. 1850)

- T.314 "Speaks in a Discussion in the Assembly on a Plan to give money to Workers Associations" (9 Feb. 1850)

- T.251 "Comments at a Meeting of the Political Economy Society on the Limits to the Functions of the State (Part 3)" (10 Feb. 1850)

- T.253 "The Balance of Trade" (29 March 1850)

- T.255 "England's New Colonial Policy. Lord John Russell's Plan" (JDE, 15 Apr. 1850)

- T.256 "Comments at a Meeting of the Political Economy Society on Land Credit" (10 Apr. 1850)

- T.248 "Abundance" (summer 1850, DEP)

- T.278 "The Society's farewell to Bastiat at a Meeting of the PES" (10 Sept. 1850)

- T.292 "On the Idea of Value" (late 1850)

- T.279 "The announcements of Bastiat's death at a Meeting of the PES and in the JDE" (10, 15 Jan. 1851)

- Appendices

- Appendix 1: Further Aspects of Bastiat's Thought (CW4)

- Bastiat's Anti-socialist Pamphlets, or "Mister Bastiat's Little Pamphlets"

- The "Apparatus" or Structure of Exchange

- Ceteris paribus, or other things being equal

- Disturbing and Restorative Factors

- Great Market: Society is one Great Market or Bazaar

- Harmony and Disharmony

- Human Action

- Leisure: The Importance of Leisure

- Service for Service

- Social Economy

- The Social Mechanism and its Driving Force

- Appendix 2: The French State and Politics (CW4)

- The French Army and Conscription

- Assignat

- Bank of France

- Chamber of Deputies and Elections

- Fortifications of Paris

- General Councils (conseils généraux de département)

- Government Administrative Regions

- Money

- National Workshops (Ateliers Nationaux)

- Tariff Policy

- Taxation

- Teaching Political Economy in the Universities

- Welfare Office (Bureau de bienfaisance)

- Appendix 1: Further Aspects of Bastiat's Thought (CW4)

- Bibliography

- A Chronological List of Bastiat's Writings (see separate file)

- Glossaries

- Glossary of Persons

- Aguado, Alexandro Maria (1784-1842)

- Aquinas, St. Thomas (1225-1274)

- Arago, Étienne Vincent (1802-1892)

- Arago, François (1786-1853).

- Argout, Appolinaire, Antoine Maurice, Comte d' (1782-1858)

- Bacon, Francis (1561-1626)

- Barrot, Hyacinthe Camille Odilon (1791-1873)

- Baudre , Jean-Baptiste de (1773-1850)

- Bentinck, Lord George (1802-1848)

- Bentham, Jeremy (1748-1832)

- Béranger, Pierre-Jean de (1780-1857)

- Bernadotte, Jean-Baptiste (1763-1844)

- Bertin, Armand (1801-1854).

- Billault, Adolphe Augustin Marie (1805-1863)

- Blanc, Louis (1811-82).

- Blanqui, Jérôme Adolphe (1798-1854).

- Bonhomme, Jacques [person]

- Brisson, Barnabé (1777-1828)

- Brutus, Marcus Junius (ca. 85-42 B.C.).

- Buffet, Louis Joseph (1818-98).

- Buckingham, Richard Grenville, 2nd Duke of (1797-1861)

- Burritt, Elihu (1810-1879)

- Cabet, Etienne (1788-1856).

- Caesar, Gaius Julius (100-44 BC)

- Carey, Henry C. (1793-1879)

- Castille, Hippolyte (1820-1886)

- Cato the Younger (95-46 BC)

- Charras , Jean-Baptiste-Adolphe (1810-1865)

- Charlemagne, Edmond (1795-1872)

- Chastellux, François -Jean, marquis de (1734-1788).

- Chateaubriand, François René, vicomte de (1768-1848).

- Chégaray, Michel-Charles (1802-1859)

- Cherbuliez, Antoine-Elisée (1797-1869)

- Cheuvreux, Hortense (née Girard) (1808-93).

- Chevalier, Michel (1806-87).

- Clément, Ambroise (1805-86).

- Cobden, Richard (1804-65).

- Colmont, Saint-Julle de (1792-??)

- Comte, Charles (1782–1837).

- Condillac, Étienne Bonnot, abbé de (1714-80).

- Considerant, Victor Prosper (1808-93)

- Coquelin, Charles (1802-1852)

- Coquerel, Athanase-Charles (père) (1795-1868) and fils (1820-1875)

- Croesus (595-547 BC).

- Coudroy, Félix (1801-74)

- Culmann, Jacques (1787-1849)

- Cuvier, George (1769-1832)

- Daire, Eugene (1798-1847).

- Darblay brothers, Auguste-Rodolphe Darblay (1784-1873) and Aymé-Stanislas Darblay (1794-1878)

- David, Irénée François (1791-1862)

- Degousée , François Rose Joseph (1795-1862)

- Demesmay, Philippe Auguste (1805-1853)

- Descartes, René (1596-1650)

- Destutt de Tracy, Antoine (1754-1836).

- Destutt de Tracy , Victor (1781-1864)

- Deucalion

- Diogenes (413-327 BC)

- Dombasle, Joseph Alexandre Mathieu de. (1777-1843)

- Droz, Joseph (1773-1850).

- Duchêne, Georges (1824-1876)

- Dunoyer, Barthélémy-Pierre-Joseph-Charles (1786-1862)

- Dupin, Charles (1784-1873)

- Dupuit, Jules (1804-1866)

- Durrieu, Simon (1775-1862).

- Dussard, Hippolyte (1791-1879).

- Enfantin, Barthélemy Prosper (1796-1864).

- Epimenides of Knossos

- Ewart, William (1798–1869)

- Falloux, Alfred-Frédéric (1811-1886)

- Faurie, François (1785-1854).

- Faucher, Léon (1803-1854)

- Fénelon (François de Salignac de la Motte-Fénelon) (1651-1715).

- Fichte, Johann Gottlieb (1762-1814)

- Flandin, Louis (1804-1877)

- Fontenay, Roger-Anne-Paul-Gabriel de (1809–91)

- Fonteyraud, Henri Alcide (1822–49)

- Fould, Achille (1800-1867).

- Fourier, François-Marie Charles (1772-1837)

- Fournier, Louis-Jacques-Marie (1786-1862)

- Fox, William Johnson (1786-1864).

- Galabert, Louis (1773-1841)

- Garnier, Joseph (1813-81).

- Gasparin, Adrien Étienne Pierre de. (1783-1862)

- Girardin, Saint-Marc (1801-73).

- Girardin, Émile de (1806-1881)

- Gracchi Brothers. Tiberius Gracchus (162-133 B.C.) and Gaius Gracchus (154-121 B.C.).

- Guillaumin, Gilbert-Urbain (1801-1864)

- Guizot, François Pierre Guillaume (1787-1874).

- Harcourt, François-Eugène, duc d' (1786-1865).

- Hegel, Georg Wilhelm Friedrich (1770-1831)

- Hill, Rowland (1795-1879)

- Hilliers, Achille, comte Baraguey d' (1795-1878)

- Hottinguer, Jean-Conrad (1764-1841)

- Hovyn de Tranchère , Jules-Auguste (1816-1898)

- Humann, Georges (1780-1842).

- Hus, Jan (1370-1415).

- Huskisson, William (1770-1830)

- Jefferson, Thomas (1743-1826).

- Jobard, Marcellin (1792-1861)

- Juvigny, Jean-Baptiste (1772-1836)

- Kant, Immanuel (1724-1804)

- Kerdrel, Vincent Paul Marie Casimir Audren de (1815-1899)

- Lakanal, Joseph (1762-1845)

- Lamarque, General Jean-Maximien (1770-1832).

- Lamartine, Alphonse Marie Louis de (1790–1869) (to do)

- Lamennais, Félicité, abbé de (1782-1854).

- Laplace, Pierre Simon, marquis de (1749–1827).

- Law, John (1671-1729)

- Lebeuf, Louis-Martin (1792-1854).

- Leclerc, Louis (1799-1854)

- Lefranc, Bernard Edme Victor Etienne (1809-83).

- Leroux, Pierre (1798-1871).

- Livy (Titus Livius) (59 BC - 17 AD)

- Louis IX (1214-1270)

- Lopez-Dubec, Salomon (1808-1860)

- Lurcy, Gabriel Pierre Lafond de. (1802-1876)

- Madison, James (1751-1836)

- Malebranche, Nicolas de (1638-1715)

- Mallet, Charles (1815-1902)

- Malthus, Thomas Robert (1766-1858).

- Manuel, Jacques André (1791-1857)

- Marrast, Armand (1801-1852)

- Mauguin, François (1785-1852)

- Midas (8th century BC)

- Mignet, François-Auguste-Alexis (1796-1884).

- Mill, James (1773-1836)

- Mimerel de Roubaix, Pierre (1786-1872).

- Mirabeau, Gabriel Honoré Riqueti, comte de (1749-91).

- "Molière," Jean-Baptiste Poquelin (1622- 1673)

- Molinari, Gustave de (1819-1912)

- Monclar, Eugène de (1800-1882)

- Mondor and Tabarin (Antoine and Philippe Girard)

- Montaigne, Michel Eyquem de (1533–92).

- Montesquieu, Charles Louis de Secondat, baron de (1689-1755).

- Morin, Étienne-François-Théodore (1814-1890).

- Nadaud, Martin (1815-1898)

- Necker, Jacques (1732-1804)

- Nemours, Duke de

- Newton, Sir Isaac (1642-1726)

- Noailles, Paul, duc de (1802-1884).

- Odier, Antoine (1766-1853).

- Owen, Robert (1771-1858).

- Pagès, Louis-Antoine (Garnier-Pagès) (1803-1878)

- Pagnerre, Laurent (1805-1854)

- Paillottet, Prosper (1804-78).

- Parieu, Félix Esquirou de (1815-1893)

- Pascal, Blaise (1623-62).

- Peel, Sir Robert (1788-1850).

- Pereire, Émile (1800-1875)

- Planat, Charles (1801-1858)

- Plutarch (46 CE - 125 CE)

- Price, Richard (1723-1791)

- Proclus Lycaeus (412-485 AD)

- Proteus

- Proudhon, Pierre Joseph (1809-65).

- Quesnay, François (1694-1774)

- Quijano, Garcia.

- Quintus Curtius Rufus (1st century AD)

- Quixote, Don

- Raudot, Claude-Marie (1801-1879)

- Renouard, Augustin-Charles (1794-1878).

- Ricardo, David (1772-1823).

- Richard, Henry (1812-1888)

- Richardet, Victor. (1810-??)

- Rodet,Denis Louis (1781-1852)

- Rondot , Cyr-François-Natalis (1821-1900)

- Rossi, Pellegrino (1787-1848).

- Rothschild Banking Family

- Rothschild, James Mayer (1792-1868)

- Rousseau, Jean-Jacques (1712-78).

- Russell, John, first Earl Russell (1792-1878).

- Saint-Beuve, Pierre (1819-1855)

- Saint-Chamans, Auguste, vicomte de (1777-1860)

- Saint-Gaudens, Jean (1799-1875)

- Saint-Simon, Claude Henri de Rouvroy, comte de (1760-1825).

- Salvandy, Narcisse Achille de (1795-1856)

- Sarrans, Jean-Bernard (1796-1874)

- Saulnier, Sébastien-Louis (1790-1835)

- Say, Horace Émile (1794-1860)

- Say, Jean-Baptiste (1767-1832)

- Sénard, Antoine (1800-1885)

- Seneca (ca. 4 BC – AD 65)

- Senior, Nassau William (1790-1864)

- Silguy, Count Jean Marie François Xavier de (1784-1864)

- Sismondi, Jean Charles Léonard de (1773-1842)

- Smith, Adam (1723-90).

- Smith, John Prince- (1809-1874)

- Steuart, James (1713-1780)

- Storch, Henri-Frédéric (1766-1835).

- Sturge, Joseph (1793-1859)

- Thierry, Jacques-Nicolas Augustin (1795-1856)

- Thiers, Adolphe (1797-1877)

- Thompson, Thomas Perronet (1783-1869).

- Thoré, Théophile, (also known as Thoré-Bürger) (1807-1869)

- Tranchère, Jules-Auguste Hovyn de (1816-1898)

- Triptolemus

- Urville, Jules Dumont d' (1790-1842)

- Vatimesnil, Antoine Lefebvre de (1789-1860).

- Vidal, François (1812-1872)

- Villèle, Jean-Baptiste, comte de (1773-1854).

- Visschers, Auguste (1804-1874)

- Vivien, Alexandre (1799-1854).

- Vuitry, Adolphe (1813-1885)

- Walras, Antoine Auguste (1801-1866)

- Wilson, James (1805-60).

- Wolowski, Louis (1810-76).

- Glossary of Places

- Glossary of Newspapers and Journals

- Le Censeur and Le Censeur européen

- La Chalosse.

- Le Courrier français (1819-1846)

- La Démocratie pacifique (1843-1851)

- Dictionnaire de l'Économie Politique (1852-53)

- Jacques Bonhomme [Journal] (June-July 1848)

- Le Journal des débats (1789-1944)

- Le Journal des Économistes

- Le Libre échange (29 Nov. 1846 - 23 Feb. 1848).

- Le Mémorial bordelais (1814-1862)

- Le Moniteur industriel (1839-)

- Le National (1830-1851)

- La Patrie (1841-)

- La Presse (1836-)

- La République française (26 February - 28 March 1848)

- Glossary of Historical Events and Terms

- Cholera Outbreak of 1849

- Le Club de la Liberté du Travail (Club for the Freedom of Working, or "Club Lib")

- Corn Laws

- International Congress of the Friends of Peace (Paris, August 1849)

- Irish Famine and the Failure of French Harvests 1846-47

- Navigation Acts

- Political Clubs

- July Monarchy (1830), February Revolution (1848), June Days (1848)

- Revolution of 1848 (also "February Revolution").

- Glossary of Groups and Organizations

- The Academy of Moral and Political Sciences

- Anti-Corn Law League.

- Association pour la liberté des échanges (The French Free Trade Association).

- Association pour la défense du travail national (Association for the Defense of National Employment)

- The Chamber of Deputies and the Electoral Class

- Girondins.

- The Party of Order.

- Physiocrats.

- The Socialist School

- Société d'économie politique (Political Economy Society)

- Glossary of Key Ideas & Concepts

- Glossary of Persons

- Endnotes

Some Additional Letters (7)↩

SourceP. Ronce, Frédéric Bastiat. Sa vie, son oeuvre (Paris: Guillaumin, 1905). Appendix, pp. 277-314.

Editor's IntroductionThere is some additional material by Bastiat in Ronce's book which was not included by Paillottet in the OC. The following are short letters or parts of letters, five of which come from his final months when he was en route to Rome where he would ultimately die of his throat condition on Christmas Eve 1850.

P. Ronce, Frédéric Bastiat. Sa vie, son oeuvre (Paris: Guillaumin, 1905). Appendix, pp. 277-314; and pieces of 6 previously unpublished letters.

- Letter 209: To M. Muiron (Eaux-Bonnes, 7 Nov. 1844), Ronce, pp. 86-87

- Letter 210: Letter to Paillottet (Pisa, 30 Sept. 1850), Ronce, pp. 253-55

- Letter 211: Letter to Paillottet (Pisa, 7 Oct. 1850), Ronce, pp. 255-56

- Letter 212: Letter to Paillottet (Pisa, 11 Oct. 1850), Ronce, pp. 256-59

- Letter 213: Letter to M. Soustra, (Pise, 12 Oct. 1850), Ronce, pp. 225-27

- Letter 214: Letter to Paillottet (Rome, 8 Nov. 1850), Ronce, pp. 260-61

1. Letter 209 to M. Muiron (Eaux-Bonnes, 7 Nov. 1844)↩

SourceLetter 209 to M. Muiron (Eaux-Bonnes, 7 Nov. 1844), in P. Ronce, Frédéric Bastiat. Sa vie, son oeuvre (Paris: Guillaumin, 1905), pp. 86-87.

Editor's IntroductionRonce tells us that this letter was written soon after Bastiat's first article "On the Influence of French and English Tariffs on the Future of the Two People" was published in the JDE (Oct. 1844) which was his breakthrough into the world of the Parisian economists. 42 In it he thanks a friend, M. Muiron, (about whom nothing is known) for having delivered his manuscript safely to the Guillaumin offices in Paris. As an outsider living in the remote south west of France, Bastiat depended on the assistance of friends like Muiron to help him get established as an author and political activist. Although he is critical in this letter of the editor of the Journal des Économistes (Hippolyte Dussard), 43 published by Urbain Guillaumin, he would soon enter Guillaumin's network of economists, politicians, and supporters, and would publish many more articles in the Journal (about 28 between 1844 and 1850) as well as numerous books and pamphlets, not to mention his Oeuvres complètes (Complete Works) the first edition of which appeared in 6 volumes in 1854-55, and a second edition in 7 volumes in 1862-64.

TextM. Muiron, 70, rue de Seine Saint-Germain, Paris.

Monsieur, the generosity which you have shown towards me and the precious moments I enjoyed with your instructive conversations make me duty bound to express all my thanks to you. I would not have delayed expressing this to you until now if I hadn't been waiting for the right moment provided by the publication of this piece which you kindly agreed to return to "M. Bastiat of Paris."

Works of this kind, even if they contain the merit of being timely and independent minded, run the great risk of getting buried in the depths of oblivion if generous friends do not bring them to the attention of the appropriate people. I hope that you will be willing to introduce the first fruits of my studies to M. de Salvandy. 44 The opinion of a man as important as he is because of his position and his stature would be a prize of infinite value for me, especially if it were of an encouraging nature. If the opposite were the case, it would still have the advantage of warning me that a man who lives in solitude must marshal his forces carefully.

The editor of the journal thought fit to cut an entire passage (on p. 149) in which I attempted to reveal the reasons why the Parisian press is in general so hostile to free trade. 45 I had the failing common to all scribblers to think that they had cut exactly what I thought most merited being kept in. Certainly, this part of my work showed at least some courage because one has to confront the fearsome power of Messrs "les journalistes." The proof of their power lies in the cuts which the editor of the journal ordered to be made.

I would be happy to learn that your good health has improved and that, in recognition of this fact, you might plan to spend another season at Les Eaux-Bonnes. 46 It would be a great pleasure to resume our walks and our conversations.

Yours sincerely…

2. Letter 216 to Félix Coudroy (1845)↩

SourceLetter 216: Letter to Félix Coudroy (1845). This letter was discovered by the original French editor Paillottet among Bastiat's papers and was inserted in a footnote to T.9 "Reflections on the Question of Dueling" (11 February 1838) which was a review in the local newspaper La Chalosse of Coudroy's pamphlet on dueling. Paillottet states it was written sometime in 1845. [OC7, p. 10] [CW1, p. 309].

Editor's IntroductionThis short letter to his boyhood friend and neighbour in Mugron Félix Coudroy 47 tells us something about Bastiat's method of writing, namely that he preferred the simplicity and directness of his first drafts. It also shows us that he was aware of a new work by one of the leading members of the circle of economists in Paris, Charles Dunoyer, 48 whose three-volume magnum opus De la liberté du travail had been published in early 1845. Dunoyer was the President of the Political Economy Society which would host a welcome dinner for Bastiat in Paris in May 1845. Coudroy and Bastiat belonged to a discussion group in Mugron called "The Academy" which would meet regularly to discuss new books and current events and where they no doubt discussed Dunoyer's book soon after it appeared. Bastiat would write but not publish a review of Dunoyer's book in March 1845 which can be found below T.20 "On the Book by M. Dunoyer. On The Liberty of Working" (March, 1845). Coudroy would later that year write a long review of Bastiat's first book on Cobden and the League for the JDE. 49

TextMy dear Félix,

Because of the difficulty of reading, I cannot properly judge the style, but my sincere conviction (you know that here I set aside the usual modesty) is that our styles have different qualities and faults. I believe that the qualities of yours are such that, when it is used, it shows genuine talent; I mean to say a style that is lively and animated with general ideas and glimpses that are luminous. Always make copies on small sheets; if one needs to be changed, it will not cause much trouble. When you are copying you will perhaps be able to add polish, but, for my part, I note that the first draft is always faster and more accessible to today's readers who scarcely go into anything in depth.

Do you not have an opinion of M. Dunoyer?

3. Letter 210 to Paillottet (Pisa, 30 Sept. 1850)↩

SourceLetter 210. Pisa, 30 Sept. 1850. Letter to Paillottet in P. Ronce, Frédéric Bastiat. Sa vie, son oeuvre (Paris: Guillaumin, 1905), pp. 253-55)

Editor's IntroductionBastiat's health continued to get worse throughout 1850. His last attendance at a session of the Chamber of Deputies was on 9 February after which he took a leave of absence. The first volume of his treatise Economic Harmonies was published in January 1850 with 10 chapters but he was too ill to work much on completing volume 2 which was eventually reconstructed from his notes and drafts by his friend Prosper Paillottet. 50 This enlarged edition of Economic Harmonies with an additional 15 chapters appeared posthumously in July 1851.

In May 1850 Bastiat left Paris and returned to his home town Mugron in Les Landes, and then went to the spa town of Les Eaux-Bonnes in June and July to recuperate and work on his two pamphlets The Law and What is Seen and What is Not Seen . He briefly returned to Paris in August but was told by his doctor that he could not survive another winter in Paris and advised him to go to Italy where the climate was less harsh. He attended his last meeting of the Political Economy Society on 10 September so he could say farewell to his friends and colleagues. 51

He took 6 weeks travelling to Rome, spending time along the way in Lyon and Marseilles (September), Pisa (October), before arriving in Rome in early November, where he stayed until his death on 24 December. His friend Prosper Paillottet went to Rome to see him during his last days, as did the Cheuvreux family who had become close friends and supporters of Bastiat. Madame Hortense Cheuvreux 52 ran an important liberal salon in Paris which Bastiat had attended over the previous two years.

One of the things Bastiat and Paillottet discussed at this time was the completion of his treatise Economic Harmonies and the editing of his Complete Works after his death. Bastiat appointed Paillottet his literary executor and with the assistance of Roger Fontenay 53 carried out Bastiat's wishes.

TextMy dear Paillottet, I left Paris on the 11th and here it is the 30th. So there you have it. Twenty days away and I have still only received a single letter from Marseilles. I keep asking at the post office and the usual answer is "there is nothing for you." I fear that they have the wrong address and there is a misunderstanding about this, as I cannot imagine my friends leaving me without any news. They must know that in this life of hardships to which I have been condemned, not being able to speak or write or to make friends, their memory is all I have to soothe my soul. How happy I would be if only they thought to write to me often! But are absent friends always in the wrong? No! I much prefer to think that it is the Post Office which is not doing its job properly. And anyway, how can they be mistaken with such a simple address: M. F. B., poste restante, Pisa, Tuscany?

My dear Paillottet, I am waiting for the arrival of what you wrote to me about from Marseilles, that is the dispatch of the box of books. 54 Sadly, I now see that they will not be of much use to me, either for reading or for working with, because the Italian climate instills in me a great feeling of far niente (doing nothing). And then, without feeling that I am sicker, it is clear that I am weaker. I do not sense it by comparing one day to the next, but if I turn my mind back one or two months I cannot fail to see my decline. If this continues for much longer I will not be able to do anything.

I suppose M. de Fontenay has returned from the countryside. Next time you see him, give him a kick in the pants to get his book on Capital published. 55 Without that, I think he is a man who will let the days and months slip by.

Pisa is a delightful place, at least the quarter where foreigners and the sick live. The Arno river forms a large semi-circle along which are houses. From my window I can see the sun from sunrise to sunset. The warmth, the light, the view of the river, the activity on the quay, makes any sad thoughts seem far away. There is not even time for boredom. One has to think that the sound morale influence of this location augurs well for my physical recovery.

Mme Cheuvreux told me that they have decided to travel here from Florence. I received this news from Marseilles. But not having received any more letters I am in an agony of uncertainty not knowing if they will change their minds. You would do me a very great service if you could make inquiries upon receipt of this letter and let me know by return mail. At the same time, tell M. Cheuvreux that, according to what I have been told, quarantine would not last longer than October 19, which is the day the State packet-boat departs. In addition, assure him that the quarantine station at Livorno is quite comfortable. Therefore I think the best plan is to board the Post ship. If I had had advance warning I would have gone to the quarantine station to reserve the best places, on the assumption that this hoax which is quarantine takes longer than expected.

Farewell my dear Paillottet. I will have your reply in only 12 days time. Like a good schoolboy I will cross myself every morning at matins.

Farewell, your devoted friend.

4. Letter 211 to Paillottet (Pisa, 7 Oct. 1850)↩

SourceLetter 211. Pisa, 7 Oct. 1850. Letter to Paillottet in P. Ronce, Frédéric Bastiat. Sa vie, son oeuvre (Paris: Guillaumin, 1905), pp. 255-56).

Editor's IntroductionIn a last flurry of activity towards the end of his life, Bastiat had to respond to the charge made against him by the American economist Henry Carey 56 that he had plagiarised Carey's work on the idea of "the harmony of interests" and his criticism of Ricardo's idea of the natural productivity of land. Bastiat's book on Economic Harmonies was circulating among the economists in Paris in manuscript form by the end of 1849 and was published by Guillaumin early the following year, in January or February. It was reviewed quite critically by Ambroise Clément in the JDE in June 1850 57 after a delay which Bastiat thought was a slight on him because of his radical new ideas. Although he lived in America, Carey read Clément's review and this provoked him into writing a letter of complaint to the Editors of the JDE in August 1850 but which was not published until January 1851, two weeks after Bastiat's death. In the letter he argued that he had expressed his ideas on harmony and land rent in his book Principles of Political Economy which was published in 1837 and that Bastiat should have cited this in his book, especially since he not not started writing about economic matters until 1844. 58

Carey's next book, with the strikingly similar title, The Harmony of Interests, was published in Philadelphia in 1851 59 but Carey's book was available in proofs at the end of 1850, probably sent by him to the Parisian economists to prove his case against Bastiat. The difficulty was in getting a copy of the proofs to the dying Bastiat in Rome in time for him to look at them. They arrived sometime in November and Bastiat wrote a reply to Carey's criticisms and sent it to the JDE just a couple of weeks before he died. They published Carey's original August 1850 letter, along with Bastiat's response, and a letter in support of Bastiat by Clément in the 15 January 1851 issue of the JDE. 60 In essence, Bastiat said he got his ideas from many sources, only one of whom was Carey (he listed in his correspondence and elsewhere that J.B. Say, Charles Comte, and Charles Dunoyer had been the major influences on his thinking) and that the idea of "the harmony of interests" was not "une individuelle invention" (an invention of an individual) of Carey or anyone else.

In spite of being saddened by Bastiat's death in December Carey continued the debate with another letter to the JDE which was published in May 1851 61 in which he responded to Bastiat and denied that he was seeking any "brevet d'invention de ces lois" (patent on these (economic) laws) but just wanted due recognition of his prior work. There was some venom in these letters back and forth which was complicated by feelings of national pride, with Bastiat not liking criticisms of French institutions by an American, and Carey in turn not liking French criticism of America, citing the work of Tocqueville and Beaumont in particular.

In the absence of his friend, Proposer Paillottet jumped in with a letter to Carey published in the June 1851 issue of the JDE 62 in which he pointed out that Bastiat had been writing on economic matters, especially on the relative contributions to the creation of "value" made by labour or land itself, as early as 1834 and could not have plagiarised Carey's 1837 work. 63

Carey's final word on the matter was penned in December 1851. 64 By then he had come to accept the idea that "the word" harmony had been used independently by many writers but that "la chose" (the thing or the theory) which lay behind its meaning could be very different. Whereas Bastiat thought that what lay behind the idea of value, including the value produced by land, was the exchange of "service for service," 65 Carey thought it was the exchange of "labour for labour." However, Carey's bigger concession was to come to realise during the course of the debate that Bastiat's views were also strongly opposed by the more orthodox economists at the JDE, like Joseph Garnier, who were staunch Ricardians and Malthusians. Thus, although he may have resented Bastiat's claim to have independently discovered the idea of "the harmony of interests," Bastiat was in fact an ally of his with his radical rethinking of the Ricardian theory of rent and Malthusian pessimism which ran along very similar lines to his own.

Another thing we learn from this letter is the real excitement Bastiat felt at the immanent arrival of the Cheuvreux family, in particular Madame Hortense Cheuvreux whose salon Bastiat had attended in Paris and to whom he was very close. She and Paillottet were the only people from his circle of Parisian economist friends who visited him in Rome as he was dying.

TextMy dear Paillottet,

I intended to reply to your kind note of 27 September but at the moment my head and my hand are tired from scribbling down the pages which are included below. I will write back you in the next day or so to discuss Carey, the books, etc. and what concerns me the most, your plans to travel in Italy with Mme Paillottet. In the meantime, I will say to you that since one has a trip like this only once in one's life, it is necessary to do this in the best possible conditions. If I get better between now and the spring, and if chatting to you is not forbidden, I don't need to tell you how much pleasure it would give me if I could be a tourist with you. But if I am like I am now, pray don't let my presence here influence your plans. I would only be a hindrance to you and thus completely ruin your plans; and you yourself, by trying to be kind to me, would cause me harm by encouraging me to talk. You can understand how delighted I am to see the arrival of the Cheuvreux family. Well, reason tells me that their presence here will be painful for me. I will suffer terribly knowing that they are so close and not being able to follow them; or at least, if I give in to this feeling I can say goodbye to what little have left of my larynx.

But whatever may happen, this is not what I am writing to you about today. My letter has a special purpose. Mme Cheuvreux writes that she leaves Paris on 14 October. Now, it is that very day that the letter I inclose will arrive in Paris. Will she receive it? Will her concierge know where to send it?

This is what I am going to ask you to do. Since I am giving Mme Cheuvreux some information about her travels, would you see that it is forwarded to her upon receipt of this letter ?

If she has already left, would you address the letter to M. Auguste Girard, Captain of Artillery at Valence and the brother of Mme Cheuvreux, and attach stamps to it so the barracks porter doesn't get it into his head to refuse to accept it.

Farewell, my dear Paillottet, your devoted friend.

5. Letter 212 to Paillottet (Pisa, 11 Oct. 1850)↩

SourceLetter 212. Pisa, 11 Oct. 1850. Letter to Paillottet in P. Ronce, Frédéric Bastiat. Sa vie, son oeuvre (Paris: Guillaumin, 1905), pp. 256-59). Only part of this letter was included in Paillottet's edition of the Oeuvres complètes and in our CW1: Letter 197. Pisa, 11 Oct. 1850. To M. Paillottet (OC1, pp. 443-44).

Editor's IntroductionWe can only speculate about the reasons why Paillottet left out this part of Bastiat's letter from his edition. In it Bastiat talks about his illness and his doctors, his worries about not being able to fulfill his duties to his electorate and the Chamber of Duties where he had been Vice-president of the Finance Committee, his fussing about the Cheuvreux's travel plans to come visit him in Italy, his embarrassment at not having said farewell to some of his friends in Paris, and matters concerning the sending of Henry Carey's manuscript to him so he could evaluate for himself the reasons for Carey's accusation of his plagiarising his work on "the harmony of interests" and the productivity of land.

Concerning his activities in the Chamber of Deputies during the Second Republic, after the Revolution of February 1848 Bastiat was elected on 23 April as a Deputy in the Constituent Assembly representing the département of Les Landes. He was soon after appointed Vice-President of the Finance Committee to which he was re-appointed 8 times. He was re-elected on 13 May as a Deputy in the Legislative Assembly representing the département of Les Landes on the "Social Democratic" list. As his health deteriorated Bastiat lost his voice and was unable to speak in the Chamber as there were 900 Deputies in a very large hall with no amplification. He tried writing his speeches as pamphlets and circulating them among the Deputies so he could reach more people. He also began taking leaves of absence from the Chamber to let his voice recover. He gave his last formal speech in the Chamber on 12 Dec. 1849, on "The Tax on Wine and Spirits" and he last spoke in the Chamber in a debate on plans to give money to Workers' Associations on 9 February 1850. 66 Shortly after this he took another leave of absence, returned to his home town of Mugron and the local spa town of Eaux-Bonnes to rest, and never returned to the Chamber.

Text[The following passage concludes the first paragraph of Letter 197 in OC and our CW1, p. 280. The following paragraphs were cut by Paillottet and then the letter continues in CW1, pp. 280-81]:

Thank God I am not dead, nor even sicker … But in the end, if the news had been true it would have been necessary to accept it and resign oneself to it. I would like all my friends to be able to adopt the philosophy I myself have adopted in this regard. I assure you that I would surrender my last breath without pain, almost with joy, if I could be sure to leave behind for those who love me, not bitter regrets but soft, affectionate, and melancholy memories. I want to prepare them for the time when I will get sicker.

[The following lines were cut by Paillottet in his edition of OC but were included in an Appendix in Ronce's book.]:

Mme Paillottet shared your worries. Tell her how much I appreciate this show of concern for me. I hope that in the spring she can reassure herself in person that my body and soul are holding together quite well, and that they will not be separated without fierce resistance. Concerning this journey, I beg you to make up you mind without any consideration regarding me. If I am better, I will let you know, and then I'm sure it would be a pleasure for both of us to be tourists together. But if I am in the same state as I am now, then your trip would be completely ruined. Even in the first situation, I have to avoid making my stay in Italy anything other than purely therapeutic. What would my electorate say, what would my colleagues say, if I, supposedly under care for my health, went to admire the marvels of Naples and Venice in the middle of the parliamentary session and after having taken a year of successive sick leave? No, that would not be acceptable. M. Andral 67 prescribed Pisa or Rome and I will limit myself to that, and I will try to spend the month of April with my family in Mugron. 68 As for the rest, we have plenty of time to talk about all these other projects. 69

When you see M. de Fontenay thank him for the recommendations he made. The one for Livorno was not useful. I hope never to have anything more to do with that town. As for a doctor, I have met one who appears to me to be a prudent and educated man. He is professor Mazzoni. After he examined me he told me that his observation was that what was suitable for my condition was healthy living rather than any remedies. Here is a doctor who doesn't want to impose himself on you.

The Cheuvreux left Paris on the 14th. It seems that their travel plans were very different from my way of undertaking a journey. Not only did they not follow my advice but their letters prove to me that they didn't even read them. There they are, leaving Paris on the 14th, just in time to miss the Post Ship which leaves Marseilles on the 19th. Now, from every perspective that was their best way to make the crossing. They will now be reduced to travelling partly by land, partly by sea, in ships loaded down with cargo, where people smoke, where there is neither first nor second class berths, no security, etc. 70 The worst is that they will remain at sea for so long, despite the portion of the journey which they will take on land. I spelled out all of this to them like so many As, Bs, and Cs. They certainly skipped over all these passages in my letters. I am really upset.

My cousin 71 hasn't written to me. However, he should have received one of my letters, one of the first letters I sent from here. If you see him, remind him about me and tell him not to neglect me in this way.

I would also be very much obliged if you could visit on my behalf M. and Mme de Planat 72 whom I was not able to visit to say my goodbyes. I don't excuse myself for this omission which only you can carry out now if you are willing to do so.

When Guillaumin 73 sends me Carey's article I will be able to see what I have to reply to. 74 I said a word or two about this to M. Say 75 yesterday. Unfortunately, I fear that our communication and the shipping of the proofs of Carey's book will be impossible because of the price. Each letter I write costs 12 sous in stamps and those I receive cost 30 sous in shipping costs. My conclusion is that shipping large parcels would be exorbitant. As for the rest, as I am nowhere near being on the road to recovery in my ability to work, the postal reform of Tuscany will have to wait. 76

6. Letter 213 to M. Soustra (Pisa, 12 Oct. 1850)↩

SourceLetter 213. Pisa, 12 Oct. 1850. Letter to M. Soustra, in P. Ronce, Frédéric Bastiat. Sa vie, son oeuvre (Paris: Guillaumin, 1905), pp. 225-27)

Editor's IntroductionBastiat was surprised and hurt by the poor reception his book on Economic Harmonies received, even by his colleagues in the Political Economy Society, when it appeared in print in January 1850. This should not have surprised him as he had published a number of articles which later became chapters in Economic Harmonies , such as the articles on competition 77 and population 78 in 1846, the opening chapters of Economic Harmonies in the JDE in January, September, and December 1848, 79 and two pieces on rent in 1849. 80 So he knew his very different views on the Malthusian population trap, the Ricardian theory of rent, and the orthodox view of the nature of value had upset some of the other economists and that they had expressed their reservations in personal conversations and at meetings of the Political Economy Society several times. 81

The Journal des Économistes was slow to publish a review of his book perhaps knowing that it would hurt Bastiat especially as his health was rapidly deteriorating. His friend Ambroise Clément 82 reviewed it some six months after it had appeared in print which was rather unusual as the JDE was quick to bring new books to the attention of its readers. 83 After making some brief remarks about his skill as a writer and complimenting him on his chapters of "Natural and Artificial organisation" and "Exchange" Clément attacked as "graves erreurs" (grave errors) Bastiat's opinions on several key issues, namely his rejection of Malthusian population theory, his rejection of the idea that land and other raw materials create "unearned" income for the owner, and his new argument value is created by the reciprocal exchange of "service for service." 84 In a posthumous review of the second enlarged edition (which appeared in July 1851) in the JDE in August 1851 Joseph Garnier 85 reprimanded Bastiat for continuing to ignore "the masters" of political economy (as well as his colleagues) whose views on value and land rent he rejected. 86 Garnier had hoped Bastiat might have left some notes or drafts written during his final year to address these criticisms. But he did not.

Another close friend, Gustave de Molinari, shared Garnier's criticism of Bastiat's theories in the obituary he wrote for the JDE which appeared in February 1851. 87 He considered Bastiat's attempts to rethink Ricardo's and Malthus' ideas to be "fâcheuse" (unfortunate), that his reformulation of the theory of value as the exchange of "service for service" a mere play on words, and that ultimately Bastiat was a popularizer of economic ideas like Benjamin Franklin, rather than an innovative theorist like J.B. Say. 88 Among his professional colleagues, only Michel Chevalier thought highly of it.

In several other letters Bastiat's expresses his frustration with the responses of what he called "middle-aged men (who) do not easily abandon well-entrenched and long-held ideas" and sadly came to believe that he was only speaking to a future generation of thinkers who might understand his ideas and develop them further. 89

This letter also gives an interesting insight into Bastiat's very critical views about the practice of journalism in France. His series of witty and clever articles known as the "economic sophisms" showed that in just a few years (1844-48) Bastiat had become a master of the craft of journalism becoming perhaps one of the greatest economic journalists who has ever lived. Many of his friends and colleagues were also journalists so he knew the profession very well.

Text… My dear Soustra, 90 don't think that the indifference shown by the journals towards my book has affected me very much. What has affected me a little (and again I begin to bore myself by talking about it) is the impossibility of seeing myself continuing to work on it. As for journalism, I have seen it too close up. It is a trade, the most trade-like thing imaginable. A man overburdened with tasks, who does not have time to read, who cannot and will not correct his ideas, who has a party line to follow, runs the business. Five or six beardless youths, who are crassly ignorant, who have no other skill than knowing how to turn a nice phrase, compose the article line by line. They never read, they never study, and they attach no importance even to the things they write. One can only compare them to a student doing his homework. Such is the Parisian press, with only a very few exceptions. Also, the signature of a well-known author confuses them. If this system can be helped, it will renew the blood of journalism which it needs very much.

Whatever the case may be, upon reflexion, I understand that in our present time, few of these young writers have been able to penetrate very far in understanding enough of my theory to review it. I would be consoled on the day when some pen or another has grasped the key idea, because then I would be sure that it has not been lost. My regret is that I have left this work in draft form. 91 There remains a lot for me to do, but this work demands strength …

7. Letter 214 to Paillottet (Rome, 8 Nov. 1850)↩

SourceLetter 214. Rome, 8 Nov. 1850. Letter to Paillottet in P. Ronce, Frédéric Bastiat. Sa vie, son oeuvre (Paris: Guillaumin, 1905), pp. 260-61)

Editor's IntroductionRonce tells us that Bastiat's spirits were lifted by the early arrival of his friends from Paris, the Cheuvreux and Bertin 92 families, to Pisa on October 22. He felt well enough to spend a day or so travelling with them to Florence. The Cheuvreux then accompanied him to Rome where he would remain until his death. He relates to Paillottet how he now suffers from boredom as he is no longer able to work on projects like rewriting his pamphlet on "Parliamentary Conflicts of Interest" (March, 1849) which the Guillaumin publishers wanted to reprint.

One interesting fact we learn from the letter is that, even at this very late stage in his illness, Bastiat still has the capacity to joke and laugh at himself, on this occasion a joke about the inefficiency of the "Roman Revenue Service" and "the seen and the unseen."

TextIt would give me great pleasure to write to you, my dear Paillottet, a long letter. But I will have to content myself (and perhaps you as well) with a short one in the style of Girardin, 93 because even though I could write for a long time I would have to confront my great physical difficulties.

I am very happy to have come to Rome where I enjoy the loving and constant care of the Cheuvreux family. Furthermore, I have been able to shake off a second illness which was growing upon the first one while I was in Pisa. It goes by the name of boredom . At last, I have had the good fortune to find here a close relative and friend (Eugène de Monclar). You can see how pleased I am with my move here. However, I ought to say that my larynx 94 does not appear ready to move into the next phase of convalescence.

You can tell Guillaumin to go ahead and reprint my pamphlet "Parliamentary Conflicts of Interests" 95 and that I approve of the measures you have taken together. However, don't think that if I were not prevented from doing so, I wouldn't resist correcting the pamphlet. I would want to cut the first part, lengthen all the examples I gave on the constitutional history of Britain, and above all correct something which I attributed to M. Thiers. 96 I was so angry to have made this mistake that, when the public discussion of it was taking place, I would have retracted my statement from the rostrum, if I hadn't forgotten to do so. But let us not dwell on the impossible.

As for the book by Carey, send it to me when and as you can. 97 If Guillaumin had some contacts in the French embassy, this way of contacting me would be convenient. As for the other matters, getting copies of the Journal des Économistes costs me in Tuscany no more than a standard letter. I don't know what it is like in the Roman States. But sending it via the Embassy is more convenient from the point of view of security than that of cheapness.

Concerning the delivery of letters, I have just learned that those which come from France in envelopes cost double. This is absurd, but it is true. If you fold it and seal it in the old fashioned manner you would save me 75 centimes that I can see and which the Roman Fisc (revenue service) does not see . 98

Our dear friend Michel Chevalier 99 has not failed us in writing a strong review in favour of my book. 100 I plan to write to him to thank him for his article which, as you can imagine, has made me very happy.

Tell me about M. de Fontenay. Is he hard at work? What is he busy with? Perhaps he should avoid concentrating all his energy for too long on a single subject. Experience has shown many thinkers that a single object of study disappears in the face of too determined research. By examining several topics at once one can see the connections between them. When he has finished working on Capital , then could work hard on something else, like Wages , or this wonderful subject which I have been busy with, the importance of the consumer .

Farewell, my dear Paillottet. Don't don't forget to mention me to our friends, and give my news to Justin.

Your devoted friend.

Early Writings: The Bayonne and Mugron Years, 1819-1844↩

Section Introduction↩

[See the Reader's Guide to the Writings of Bastiat]

1. T.296 (before 1830) "On the Romans as Plundering Villains"↩

SourceT.296 (before 1830) "On the Romans as Plundering Villains" (sometime before 1830). This previously unpublished sketch was discovered by the original French editor Paillottet among Bastiat's papers and inserted in a footnote to "Baccalaureate and Socialism". He estimated that it had been written sometime before 1830. [OC4, pp. 454-55] [CW2, pp. 194-95] </titles/2450#lf1573-02_footnote_nt177>

Editor's IntroductionThis very short piece is an early expression of the great hostility Bastiat showed towards Ancient Greece and Rome, which was so admired by his contemporaries and played such as crucial role in French education. He mentions this several times in his theoretical work, in his letters, and in his speeches and articles on educational reform. He rejected the morality of the ancient Romans in particular who were warriors and slave owners who kept the majority of the Roman people in political subjection and ruled the rest of the Mediterranean world as subjects of their ever growing empire. The Romans disliked manual labor, used violence to maintain their economic privileges and political rule, and regarded war and the warrior virtues as supreme. For all these reasons, Bastiat despised the Romans.

In his writings on the theory of plunder, Bastiat placed Roman slavery at an early point in the evolution of European society which he saw as moving from primitive plunder, through war, slavery, theocracy, monopoly, governmental exploitation, and communism (or what he called "false fraternity").

Bastiat's very first reference to Rome was in a letter to his friend Victor Calmètes (8 December, 1821) which set the tone for his views for the remainder of his life:

In Rome, wealth was the fruit of chance, birth, and conquests; today, it is the reward only of work, industry, and economy. In these circumstances, it is nothing if not honorable. Only a real fool taken from secondary school would scorn a man who knows how to acquire assets with honesty and use them with discernment. 101

As someone who attended an experimental school in Sorèze, where modern languages, history, and music were taught, Bastiat believed that the study of the Latin language and Roman classics in government schools help twist the minds of modern-day youth and prejudiced them against voluntary cooperation and industrious work. As he stated in an early article "On a New Secondary School to Be Founded in Bayonne" (1834) he warned educators about teaching pupils too much about the Romans:

For what is there in common between ancient Rome and modern France? The Romans lived from plunder and we live from production, they scorned and we honor work, they left to slaves the task of producing and this is exactly the task for which we are responsible, they were organized for war and we aim for peace, they were for theft and we are for trade, they aimed to dominate and we tend to bring peoples together.

And how do you expect these young men who have escaped from Sparta and Rome not to upset our century with their ideas? Will they not, like Plato, dream of illusory republics; and like the Gracchi, have their gaze fixed on the Aventine Mount; and like Brutus, contemplate the bloody glory of sublime devotion? 102

He was still saying the same thing during the Revolution of 1848 where he stated in an article on "The Scramble for Office" in his revolutionary newspaper La République française (March, 1848) that:

In a country in which, since time immemorial, the labor of free men has everywhere been demeaned, in which education offers as a model to all youth the mores of Greece and Rome, in which trade and industry are constantly exposed by the press to the scorn of citizens under the label profiteering, industrialism, or individualism, in which success in office alone leads to wealth, prestige, or power, and in which the state does everything and interferes in everything through its innumerable agents, it is natural enough for public office to be avidly sought after.

How can we turn ambition away from this disastrous direction and redirect the activity of the enlightened classes toward productive careers? 103

In one of the last major pieces he wrote in his final year, Baccalaureate and Socialism , which is his most extended work on the defects of a classical education and "Roman morals," he attributed much of the violence and interventionist legislation during the recent revolution to the classical ideas taught in French schools:

The causes of the Revolution probably had no connection with a classical education, but can we doubt that this form of education contributed a host of mistaken ideas, sadistic feelings, subversive utopias and deadly experimentation? Read the speeches made in the Legislative Assembly and the Convention. They are in the language of Rousseau and Mably. They are just tirades in favor of, and invocations and exclamatory addresses to, Fabricius, Cato, the two Brutuses, the Gracchi, and Catilina. Is an atrocity going to be committed? There is always the example of a Roman to glorify it. What education has instilled in the mind is translated into act. Sparta and Rome are agreed on as models and so they must be imitated or parodied. One person wants to establish the Olympic Games, another the agrarian laws and a third (the distribution of) black broth in the streets. 104

For a similar early diatribe against the Romans see "On the Romans and Self-Sacrifice" below. 105

TextDistance contributes not a little to giving antique figures an aura of greatness. If Roman citizens are mentioned to us, we do not normally conjure up a vision of a robber intent on acquiring booty and slaves at the expense of peaceful peoples. We do not visualize him going about half naked, hideously dirty in muddy streets. We do not come across him whipping a slave who shows a bit of initiative and pride until the robber draws blood or kills him. We prefer to conjure up a fine head set on a bust brimming with force and majesty and draped like an ancient statue. We prefer to contemplate this person as he meditates on the great destiny of his fatherland. We seem to see his family around the hearth honoring the presence of the gods, with his wife preparing a simple meal for the warrior and casting a confident and admiring look on the brow of her husband and the children and paying attention to the words of an old man who whiles the hours away reciting the exploits and virtues of their father. …

Oh! How many illusions would disappear if we could evoke the past, wander in the streets of Rome, and see at close hand the men whom we admire from afar in such good faith!

2. T.297 (before 1830) "On the Romans and Self-sacrifice"↩

SourceT.297 (before 1830) "On the Romans and Self-sacrifice" (before 1830). This previously unpublished sketch was discovered by the original French editor Paillottet among Bastiat's papers and inserted in a footnote to "Baccalaureate and Socialism". He estimated that it had been written sometime before 1830. [OC4, pp. 490-91] [CW2, pp. 223-24] </titles/2450#lf1573-02_label_299>

Editor's IntroductionSee the Editor's note above on Bastiat's attitude towards the Romans.

TextWhen I sacrifice part of my wealth to build walls and a roof that will protect me from thieves and the weather, it cannot be said that I am driven by self-renunciation but that on the contrary I am endeavoring to preserve myself.

In the same way, when the Romans sacrificed their internal divisions in favor of their security, when they risked their lives in combat, when they subjected themselves to the yoke of an almost unbearable discipline, they were not practicing self-renunciation; on the contrary they were embracing the sole means they had of preserving themselves and escaping the destruction with which they were threatened by the reaction of other peoples to their acts of violence.

I know that several Romans demonstrated great personal self-sacrifice and devoted themselves to saving Rome. But there is an easy explanation for this. The interest that determined their political organization was not their only motive. Men accustomed to conquering together, to hating everything foreign to their society, had to have an exalted degree of national pride and patriotism. All warlike nations, from primitive hordes to civilized peoples who make war only accidentally, experience patriotic exhilaration. This is all the more true of the Romans, whose very existence was based upon permanent war. This thrilling national pride, combined with the courage born of warlike customs, the scorn of death it inspired, the love of glory, and the desire to live on in posterity, had frequently to produce dazzling exploits.

For this reason, I do not say that no virtue can arise in a society that is purely military. I would be contradicted by events, and the bands of robbers themselves offer us examples of courage, energy, devotion, a scorn of death, generosity, etc. However, I claim that, like these bands of plunderers, these nations of plunderers, from the point of view of self-renunciation, do not win out over industrious nations, and I will add that the enormous and continuous vices of the former cannot be erased by a few dazzling exploits, which are perhaps unworthy of the name of virtue, since they work to the detriment of humanity.

3. T.289 "The Poetry of Civilization" (c. 1830)↩

SourceT.289 (1830.??) "The Poetry of Civilization" (La Poésie de la Civilisation). Ronce says he found this in Bastiat's papers and thinks it was written sometime before 1830. In Ronce, Appendix VI, pp. 302-3.

Editor's IntroductionBastiat was about 29 when he wrote this short piece sometime during 1830 when the July Revolution took place. 106 For someone who disliked ancient Greek and Roman culture so much, he dropped a lot of classical references in this short essay, perhaps to show that he was not ignorant of it, but rather opposed it for moral and economic reasons.

It is also interesting for the kind words he has to say about his friend, Étienne Vincent Arago (1802-1892), with whom he probably went to the same progressive school in the town of Sorèze. 107 Étienne was the youngest brother of the famous Arago family, and like Bastiat, he was elected after the Revolution to the Constituent Assembly and served as Director General of the Post Office where he began implementing reforms which were very dear to Bastiat's heart. During the 1820s he was active in Carbonari circles and in the 1830 Revolution he took part in the fighting on the barricades as an ally of Lafayette's group, while Bastiat remained behind in Bayonne where he too played a small role in helping the new "constitutional monarch" Louis Philippe come to the throne. While Étienne was on the barricades in Paris, Frédéric was drinking red wine and singling political songs with the officers of the Bayonne citadelle, thus helping them decide to side with the revolution and oppose the deposed King Charles X. As he wrote to his friend Félix Coudroy:

The 5th at midnight

I was expecting blood but it was only wine that was spilt. The citadel has displayed the tricolor flag. The military containment of the Midi and Toulouse has decided that of Bayonne; the regiments down there have displayed the flag. The traitor J—— thus saw that the plan had failed, especially as the troops were defecting on all sides; he then decided to hand over the orders he had had in his pocket for three days. Thus, it is all over. I plan to leave immediately. I will embrace you tomorrow.

This evening we fraternized with the garrison officers. Punch, wine, liqueurs, and above all, Béranger contributed largely to the festivities. Perfect cordiality reigned in this truly patriotic gathering. The officers were warmer than we were, in the same way as horses which have escaped are more joyful than those that are free.

Farewell, all has ended. 108

Étienne Arago made a name for himself as a prolific and successful playwright throughout the 1820 and 1840s writing very political plays such as Mandrin, mélodrame en 3 actes (1827), about Louis Mandrin (1725-55) the famous 18th century brigand and highwayman, and Les Aristocraties (1847), which was a strong republican attack on the privileges of the aristocracy.

Bastiat also knew the oldest Arago brother François (1786-1853) who was a famous astronomer and physicist whose work was noticed by Laplace who got him the position of secretary and librarian at the Paris Observatory. In one of the sophisms he wrote in 1847 109 Bastiat appealed directly to François Arago to help him develop the more sophisticated mathematics which he needed in order to calculate more precisely the losses imposed on the economy by tariff protection and subsidies, thus making his arguments more "invincible." We do not know if François ever replied to his letter.

Text… There are two kinds of poetry. One is the product of the imagination; the other is the story of human feelings.

I am quite inclined to think that materialism, or to put it better, "Pryrrhonism," 110 destroys the poetry of the imagination. But one can say the same of all truth. It is quite evident that as the circle of science expands that of the imagination contracts, since one can only imagine what one doesn't know. The latter explains why the people of antiquity had more imagination that modern people. Not knowing anything about causes they imagined them to be their own creation. It was not only poets who created things but philosophers as well , and the people too.

Even in our own time, rough and ignorant men, because they are ignorant, revel in chimeras, because only the man who has reflected a great deal and who is often mistaken can say " I don't know. " Peasants explain all phenomena which they are aware of, as being under the influence of the moon, the stars, sorcerers, and saints, etc. By enlightening them you dry up these springs of the imagination.

Think of the time when Christianity replaced Paganism. Didn't we see the same fears about the pleasures of the imagination? If your religion dominates all beliefs, the Pagans said, what will become of poetry? Olympus will now only be an ordinary hill, Parnassus only a lump of dirt and granite, rivers will be denuded of Naiads, and trees of Dryads, fauns, and wood nymphs. 111 Beauty (Aphrodite) will no longer be the daughter of the day and the waves; she will be stripped of her belt and Love (Cupid) will no longer have his arrows and blindfold. 112 You will no longer have dwelling places of the gods but fences and hedges; you will no longer have divinities of the hearth but a gloomy fire place. Peace, Concorde, Victory, Filial Piety, Modesty will no longer be gentle deities. The Dawn, Iris, will lose their colors and their charm. 113 The Sun will no longer be a chariot pulled by Apollo's chargers across the sky; 114 and the Moon will now only be a mundane satellite of the Earth. This is what they will no doubt say.

After this mythology has disappeared other mythologies will have their turn; but if the poetry of the imagination has been lost, that of the heart will replace it; and I am truly surprised that you, in order to convince me, so often call upon the marvels of nature, that you don't want to let me believe that, after all is said and done, the truth, the simple truth, is more beautiful than the most brilliant products of the human imagination.

Believe me, my friend, there is more poetry in the head of Arago that in that of Homer.

4. T.104 "Letter to M. Saulnier, Editor of La Revue britannique , (on the cost of government in the U.S. and France)" (c. 1831)↩

SourceT.104 (undated, possibly 1831) "Letter to M. Saulnier, Editor of La Revue britannique (on the cost of government in the U.S. and France)." Paillottet included this letter in a footnote with the pamphlet Peace and Freedom or the Republican Budget (Feb. 1849). He states in was written "in his retreat in Mugron many years ago" but gives no specific date. It was most likely written as the debate was being conducted in the pages of La Revue britannique or shortly thereafter . [OC5, pp. 443-45] [CW2, pp. 308-10].

Editor's IntroductionFor the classical liberals of Bastiat's day, the United States was seen as an excellent example of a working limited, decentralised, and low cost government, in contrast to the highly centralised, bureaucratic, and expensive French state. In 1831 a debate took place in La Revue britannique which was edited by Sébastien-Louis Saulnier 115 who took issue with a speech given by General LaFayette in the Chamber on the relative costs of the French and American governments to their respective citizens. James Fenimore Cooper (who had lived in France for two years in the late 1820s) took the side of Lafayette who argued that the American government was the lowest cost government in the world. 116 This view was challenged by the editor Saulnier and an American diplomat, Mr. Harris, in La Revue britannique and some of the articles were published as separate pamphlets. 117 Bastiat must have read this exchange with considerable interest as his own political interest was beginning to show itself at this time: he played a small part in the July Revolution in 1830 which brought Louis Philippe to the throne, he was appointed Justice of the Peace in Mugron in May 1831, stood unsuccessfully for election to the local legislature in July 1831, and in November 1833 he was elected to the General Council of Les Landes.

In this letter to the editor (which Paillottet says was never sent) we see evidence of Bastiat's interest in economic data concerning tax rates and his belief in a very limited government as embodied in the American example. It also shows that he kept abreast of events in Britain and America by reading La Revue britannique which would become even more important to him when he discovered the activities of Richard Cobden and the Anti-Corn Law League in the early 1840s.

TextTo M. Saulnier

Editor of La Revue britannique

Dear Sir,

You have filled with transports of joy in all those who find the word economics absurd, ridiculous, unacceptable, bourgeois, and mean. The Journal des débats extols you, the president of the council quotes you, and the favors of government are waiting for you. However, what have you done, sir, to merit so much applause? You have established through figures (and everyone knows that figures never lie) that it costs the citizens of the United States more than the subjects of France to be governed. 118 This gives rise to the harsh consequence (harsh for the people in fact) that it is absurd to wish to place limits on the lavishness of power in France.

But, sir, and I ask your pardon and that of the centres for economics and statistics, your figures, assuming they are correct, do not seem to me to be unfavorable to the American government.

In the first place, to establish that one government spends more than another does not give any information on their relative goodness. If one of them, for example, is administering a nascent nation that has all its roads to build, all its canals to dig out, all its towns to pave, and all its public establishments to create, it is natural that it spends more than one that has scarcely more to do than maintain its existing establishments. Well, you know as well as I do, sir, that spending that way is to save and create capital. If it were done by a farmer, would you be confusing the investments that an initial establishment requires with his annual expenditure?