Liberty Matters

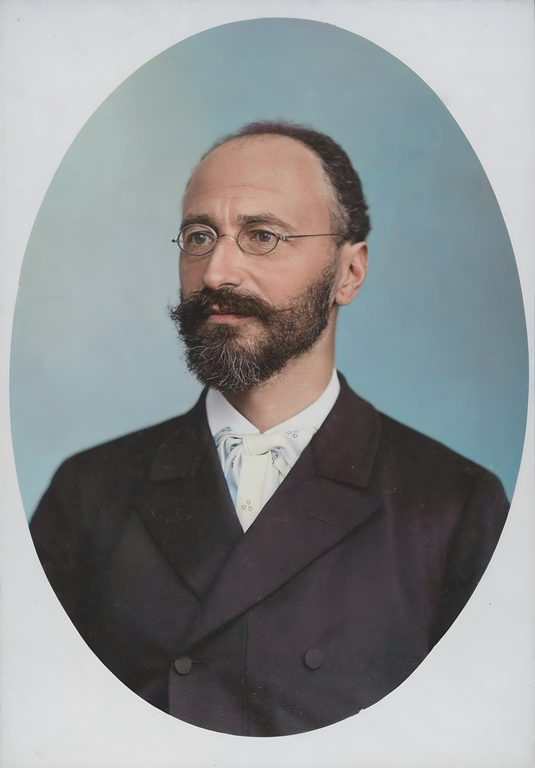

Böhm-Bawerk and Micro-Foundations to Capital and the Market Process

As Dr. Lewin points out in his remarks, above, on “Bear Barrels, Blast Furnaces, and Hotel-room Furniture,” the advantage of an approach such as that of the “Austrians” is precisely that it focuses on the microeconomic relative price and wage, and capital structure relationships that are at work beneath the macroeconomic surface of Keynesian-type aggregates and averages.

As Dr. Lewin points out in his remarks, above, on “Bear Barrels, Blast Furnaces, and Hotel-room Furniture,” the advantage of an approach such as that of the “Austrians” is precisely that it focuses on the microeconomic relative price and wage, and capital structure relationships that are at work beneath the macroeconomic surface of Keynesian-type aggregates and averages.Indeed, the Austrian economists, and most certainly including Eugen von Böhm-Bawerk, insisted from the beginning on what has become known as firm “micro-foundations” to macroeconomics. This is the basis of their long-standing insistence on methodological individualism and methodological subjectivism.

Intentionality and the Planning and Maintaining of the Capital Structure

It is the leading reason for the Austrian rejection of an economic analysis that’s grounded on or operates primarily in terms of aggregates and averages. We saw it in Böhm-Bawerk’s criticisms of John Bates Clark’s notion of a perpetuated “fund” of capital. For Böhm-Bawerk, “capital” is comprised of specific intermediary products designed and invested in precisely to assist individual human actors for a more productive use of their own labor and complementary resources and raw materials in the manufacturing of desired consumer goods.

Individuals must intentionally devote time and effort to produce those capital goods, utilize them in time-consuming structures of complementary and interdependent stages of production that lead to a final, finished products anticipated to serve the ends of specific individuals.

The decision to produce such capital goods must be followed with plans and actions to maintain them, and to increase and improve them looking to the future. There is nothing “automatic” in this process that is independent of individual human choices concerning valuations involving alternative wants that can be satisfied closer to the present or further away in the future.

The Austrian Critique of the Aggregate “Price Level”

This same methodological view was behind Austrian criticisms of the theoretical and policy attention that was given to the notion of the general “price level” in the 1920s and 1930s. For instance, Ludwig von Mises had emphasized that all attempts to measure changes in the purchasing power of the monetary unit through construction of index numbers invariably hid from view the fact that all monetary changes (either an increase or a decrease in the quantity of money in circulation) only influence “prices in general” as the cumulative effect brought about through money’s impact on the structure of relative prices starting from the point from which the monetary change is introduced into the economic system.[90]

In other words, monetary changes are inescapably “non-neutral” in their affect on the “real” economy. Monetary influences on the price structure modify relative profit margins as long as the monetary change is working its way through the market, and this influences the allocation of resources, labor and capital among their alternative uses.[91]

“Injections” of money and credit into the banking system are one way that such monetary-induced changes being about a “misdirection” in relative prices and capital uses resulting in the phases of the business cycle.

All this is hidden from sight and insight when the analytical focus is on changes in the general price level and output “as a whole.” As Gottfried Haberler emphasized almost 90 years ago, “The general price level is not a given, self-evident fact, but a theoretical abstraction . . . An economically relevant definition of the price level cannot be independent of the purpose in mind” for which it has been conceptually constructed. And when applied to explaining the sequences and phases of the business cycle, “Such a general [price] index rather cancels and submerges than reveals and explains those price movements which characterize and signify the movement of the cycle.”[92]

Or as Friedrich A. Hayek generalized the argument in a famous passage in Prices and Production, in which he pointed out the futility of the attempt “to establish direct causal connection between the total quantity of money, the general level of all prices and, perhaps, also the total amount of production.”

For none of these magnitudes as such ever exerts an influence on the decisions of individuals; yet it is on the assumption of a knowledge of the decisions of individuals that the main propositions of non-monetary economic theory are based. It is to this “individualistic” method that we owe whatever understanding of economic phenomena we possess; that the modern “subjective” theory has advanced beyond the classical school in its consistent use is probably its main advantage over their teaching.If, therefore, monetary theory still attempts to establish causal relations between aggregates and general averages, this means that monetary theory lags behind the development of economics in general. In fact, neither aggregates nor averages do act upon one another, and it will never be possible to establish necessary connections of cause and effect between them as we can between individual phenomena, individual prices, etc. I would even go so far as to assert that, from its very nature of economic theory, averages can never form a link in its reasoning . . .[93]

The Austrian insistence on the importance of analysis in terms of the relative price and production structural relationships was also strongly emphasized by Arthur W. Marget (surely the most widely read and knowledgeable monetary theorist of the interwar period) in his critique of Keynesian macroeconomics:

It is a fundamental methodological proposition of "modern" versions of the "general" Theory of Value that all categories with respect to "supply" and "demand" must be unequivocally related to categories which present themselves to the minds of those "economizing" individuals (or individual business firms) whose calculations make the "supplies" and "demands" realized in the market what they are . . . [T]he type of problem raised by the necessity for establishing a relation between these "microeconomic" decisions and these "macroeconomic" processes is not solved by the arbitrary introduction of an "aggregate supply function" and an "aggregate demand function" for industry as a whole, in defiance of the fact that neither of these "functions" deals with elements which enter directly into the calculations of the individual entrepreneurs whose "microeconomic" decisions and actions make "macroeconomic" processes what they are. On the contrary, it must be said, of such an attempt at "solution," that it misconceives entirely the true nature of the relation between microeconomic analysis and macroeconomic analysis.[94]

As both Dr. Lewin and Dr. Garrison highlighted in their earlier comments, Böhm-Bawerk erred in his construction of a notion of a backward-looking “Average Period of Production.” And this concept, perhaps more than any other in his writings on capital and its time-structure, ended up causing the most confusion and controversy in terms of his legacy. It may be even argued that it was one of the central factors in the rejection of Austrian capital theory in the 1930s and 1940s.[95]

But what it also inspired was several restatements and reorientations of the Austrian theory of capital in the post-World War II period and especially in the years following the “Austrian” revival in the 1970s, while remaining true to the Böhm-Bawerkian emphasis on capital goods as intermediate goods within time-structures of production guided by individual plans focused on anticipated future consumer demands.

In this, the writings of Ludwig M. Lachmann must be given especial mention and attention. In the 1940s, Lachmann had challenged the Keynesian conception of capital as an aggregate of homogeneous and (implicitly) perfectly interchangeable goods. Particularly in two articles, “Complementarity and Substitution in the Theory of Capital” (1947)[96] and “Investment Repercussions” (1948),[97] he argued that capital needed to be looked at in terms of their construction and use in complementary structural relationships in and through time. Changes in plans caused by discovered changes in underlying supply and demand conditions held the potential of transforming those capital complementarities, with needed restructuring involving capital goods substituted into new complementary relationships in the face of those market changes.

Central to Lachmann’s argument, and one that he expanded upon and refined in Capital and Its Structure (1956), was that the Keynesian macroeconomic approach was highly superficial and deceptive in that it submerged under the aggregate “marginal efficiency of capital” all of these microeconomic interrelationships in the uses of capital that helped understand the causes and consequences of economic imbalances and distortions during the business cycle.[98]

The restatement of Austrian capital theory (especially in its Böhm-Bawerkian and Hayekian forms) by Murray N. Rothbard in his monumental economics treatise on thoroughgoing “Austrian” lines, Man, Economy, and State (1962), resulted in a “rediscovery” of this tradition by a new generation of young Austrian economists.[99]

This was reinforced with Israel M. Kirzner’s An Essay on Capital (1966) that focused attention on the conception of multi-period plans, and the use of capital through time in complementary relationships within the same plan and between plans.[100]

Out of this revival have come, most significantly, Peter Lewin’s Capital in Disequilibrium: The Role of Capital in a Changing World (1999)[101] and Roger Garrison’s Time and Money: The Macroeconomics of Capital Structure (2001).[102] In these works, Böhm-Bawerk’s legacy as reflected in Lachmann’s and Hayek’s contributions to capital theory have been refined and applied to the capital controversies and macroeconomic debates of the last half-century.

And at a macroeconomic analysis and policy level, Mark Skousen’s formulation of Böhm-Bawerk’s and Hayek’s structure of production conception is now the basis of a new quarterly measurement of “Gross Output” by the Bureau of Economic Analysis. Looking beyond the standard Gross Domestic Product approach of a measurement of the market value of final goods and services during a given period, it incorporates the sales and receipts through the stages of production for a better appreciation of on-going gross investment in the production structure.[103]

A century, now, after Böhm-Bawerk’s death in August 1914, his ideas on capital, interest and investment continue to offer as a general framework and inspiration for the Austrian School of Economics in the 21st century.

Endnotes

[90.] Ludwig von Mises, The Theory of Money and Credit (Indianapolis, IN: Liberty Classics, [1934; new ed., 1953] 1980) pp. 215-223; Mises, Monetary Stabilization and Cyclical Policy [1928] in On the Manipulation of Money and Credit (Dobbs Ferry, NY: Free Market Books, 1978) pp. 83-89; Mises, “The Suitability of Methods of Ascertaining Changes in Purchasing Power for the Guidance of International Currency and Banking Policy,” [League of Nations Official No. F/Gold/51 Oct. 10, 1930] in Richard M. Ebeling, ed., Money, Method and the Market Process: Essays by Ludwig von Mises (Norwell, MA: Klewer Academic Books, 1990), pp. 78-95; Mises, Human Action: A Treatise on Economics (Chicago: Contemporary Books, [1949] 3rd revised ed., 1966) pp.219-223.

[91.] Mises, “The Non-Neutrality of Money” [1938] in Ebeling, ed., Money, Method, and the Market Process, pp. 69-77; see, also, Oskar Morgenstern, "Thirteen Critical Points in Contemporary Economic Theory: An Interpretation," Journal of Economic Literature, Vol. 10, no. 4 (December 1972): 1184; reprinted in Andrew Schotter, ed., Selected Economic Writings by Oskar Morgenstern, (New York: New York University Press, 1976), p. 288:

“[If] no account is given where this additional money originates from, where it is injected, with what different magnitudes and how it penetrates (through which paths and channels and with what speed), into the body economic, very little information is given. The same total addition will have different consequences if it is injected via consumer's loans, or producer's borrowings, via the Defense Department, or via unemployment subsidies, etc. Depending on the existing conditions of the economy, each point of injection will produce different consequences for the same aggregate amount of money, so that the monetary analysis will have to be combined with an equally detailed analysis of changing flows of commodities and services.” [Emphasis in original.]

[92.] Gottfried Haberler, “A New Index Number and Its Meaning” Quarterly Journal of Economics (May, 1928), reprinted in, Anthony Y. C. Koo, ed., The Liberal Economic Order: Essays by Gottfried Haberler, Vol. II: Money, Cycles and Related Themes (Brookfield, VT: Edward Elgar, 1993) pp. 114-115; see, also, Haberler, The Different Meanings Attached to the Term ‘Fluctuations in the Purchasing Power of Gold’ and the Best Instrument or Instruments for Measuring Such Fluctuations (Geneva: League of Nations, Official No.: F/Gold/74, March 9, 1931).

[93.] F. A. Hayek, Prices and Production [1931; 2nd ed., 1935] reprinted in Hansjoerg Klausinger, ed., The Collected Works of F. A. Hayek, Vol. 7: Business Cycles, Part I (Chicago: University of Chicago Press, 2012) pp. 195-196.

[94.] Arthur W. Marget, The Theory of Prices, Vol. 2 (New York: Augustus M. Kelley, [1942] 1966), pp. 541 & 544; see, also, Raymond J. Saulier, Contemporary Monetary Theory: Studies of Some Recent Theories of Money, Prices, and Production (New York: Columbia University Press, 1938), pp. 379 & 358, where in a critique of Keynes’ General Theory, the author says:

“The effects of monetary factors on the various elements of the price system must be studied with reference to the supply conditions of particular goods . . . There is not such thing as demand for goods in general, a general price level, the output of goods in general (even when categorized into producers’ and consumers’ goods), except as aggregates and averages of particular phenomena. What we have in fact is a set a set of demand and supply conditions for all the various goods and services of the community. If money exerts any influence on the price of a good, or upon its rate of output, it does so because it affects its particular cost and revenue conditions. Therefore, if we are to study the modus operandi of this effect we must do it in terms of changes in the demand (revenue) and supply (cost) conditions of that particular good. Our whole problem would be infinitely simplified, and much of this analysis could be avoided, if any given change in the money stock would raise all demand curve immediately and proportionally, and would alter all cost curves in an equally harmonious manner, or, alternatively, if the monetary disturbance would cause different degrees of change in the prices of different goods which could be dealt with in terms of an average change, without this procedure causing any of the important relations within the price structure to be overlooked. I think no one would be likely to argue that either of these happy states of affairs is apt to obtain . . . It can be said quite definitely that a closer attention to the particular and special conditions of different elements of the economic system, will yield a better understanding of how money affects the economic system . . . There is some possibility that a statement of price theory which centers as much interest as does Keynes’s theory on changes in prices [in general] may have the quite undesirable effect of diverting attention fro the relations between costs and prices – that is, from changes in the cost-price structure.”

[95.] For a detailed summary of the controversies and debates surrounding Austrian capital theory in the first half of the 20th century, as well as a restatement of Austrian capital theory, see, Mark Skousen, The Structure of Production (New York: New York University Press, 1990), a work not always appreciated as much as it deserves to be.

[96.] Ludwig M. Lachmann, “Complementarity and Substitution in the Theory of Capital,” Economica (May, 1947) reprinted in Walter E. Grinder, ed., Capital, Expectations, and the Market Process: Essays on the Theory of the Market Economy by Ludwig M. Lachmann (Kansas City: Sheed, Andrews, and McMeel, 1977) pp. 197-213.

[97.] Ludwig M. Lachmann, “Investment Repercussions,” Quarterly Journal of Economics (Nov. 1948) reprinted in Don Lavoie, ed., Expectations and the Meaning of Institutions: Essays in Economics by Ludwig M. Lachmann (New York: Routledge, 1994) pp. 131-144.

[98.] Ludwig M. Lachmann, Capital and Its Structure (Kansas City: Sheed Andrews and McMeel [1956] 1978).

[99.] Murray N. Rothbard, Man, Economy, and State: A Treatise on Economic Principles (Princeton, NJ: D. Van Nostrand, 1962.)

[100.] Israel M. Kirzner, An Essay on Capital [1966] reprinted in Essays on Capital and Interest: An Austrian Perspective (Brookfield, VT: Edward Elgar, 1996 pp. 13-122.

[101.] Peter Lewin, Capital in Disequilibrium: The Role of Capital in a Changing World (New York: Routledge, 1999).

[102.] Roger W. Garrison, Time and Money: The Macroeconomics of Capital Structure (New York: Routledge, 2001).

[103.] Mark Skousen, The Structure of Production.

Copyright and Fair Use Statement

“Liberty Matters” is the copyright of Liberty Fund, Inc. This material is put on line to further the educational goals of Liberty Fund, Inc. These essays and responses may be quoted and otherwise used under “fair use” provisions for educational and academic purposes. To reprint these essays in course booklets requires the prior permission of Liberty Fund, Inc. Please contact oll@libertyfund.org if you have any questions.