Liberty Matters

Spencer on Banking

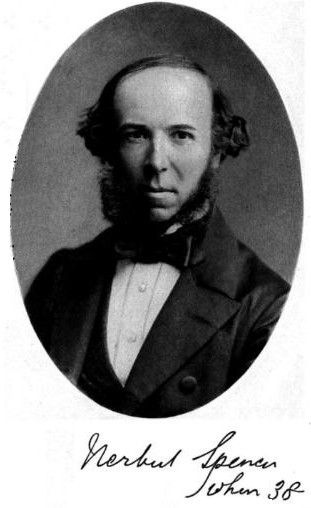

Since in my initial essay I cast aspersions on Spencer’s capacities as an economic thinker, I want to do him justice by briefly discussing an excellent and little-known 1858 economic essay of his on “State Tamperings With Money and Banks.” (Thanks to Jeff Tucker for recently reminding me of this piece.)

In the essay, Spencer places the blame for recessions and depressions on an “excessive issue of notes” by the central bank, since when “actual payments” are replaced by “an immense number of promises-to-pay,” the result is that “part of the claims cannot be liquidated.”[131] Spencer’s account can be seen as a partial anticipation of the Austrian theory of the business cycle.

In lieu of the Rothbardian-style 100-percent-gold-reserve standard, Spencer favours a free-banking approach, counting on competition and contract enforcement to place a check on the overissue of notes

Alberto mentions the oddity of Hayek’s calling Spencer an economist. But Spencer’s proposals are parallel in some respects to Hayek’s own suggestions for monetary reform in Denationalisation of Money.[132] In any case, Hayek was fairly free with the term “economist,” since he called Ayn Rand an economist too – even “one of three outstanding woman economists.”[133]

Endnotes

[131.] Herbert Spencer, “State Tamperings With Money and Banks,” in Essays: Scientific, Political, and Speculative: Library Edition, containing Seven Essays not before republished, and various other Additions (London: Williams and Norgate, 1891),Vol. 3. </titles/337#Spencer_0620-03_433>

[132.] Friedrich A. Hayek, Denationalisation of Money – The Argument Refined: An Analysis of the Theory and Practice of Concurrent Currencies (London: Institute of Economic Affairs, 1990). <https://mises.org/sites/default/files/Denationalisation%20of%20Money%20The%20Argument%20Refined_5.pdf>

[133.] Quoted in Alan Ebenstein, Friedrich Hayek: A Biography (New York: Palgrave Macmillan, 2001), p. 275.

Copyright and Fair Use Statement

“Liberty Matters” is the copyright of Liberty Fund, Inc. This material is put on line to further the educational goals of Liberty Fund, Inc. These essays and responses may be quoted and otherwise used under “fair use” provisions for educational and academic purposes. To reprint these essays in course booklets requires the prior permission of Liberty Fund, Inc. Please contact oll@libertyfund.org if you have any questions.