Liberty Matters

Breaking Open the Black Boxes of Political Economy

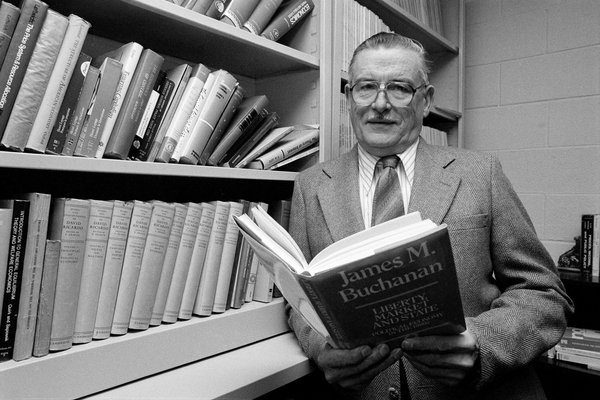

Geoffrey Brennan has given us a very comprehensive once-over-lightly treatment of the breadth of James Buchanan’s contributions. In reading it, I was struck again by that very breadth and how Buchanan was a major figure in several fundamental areas in economics. One of the great joys of reading his work is that, perhaps more than any other 20th century economist aside from F. A. Hayek, Buchanan asked questions that penetrated to the core of economics as a discipline. He was a master at stepping back from the conversation and asking us all to consider what it all meant and whether we were even talking about the right thing. His legacy, I believe, will be the ways in which he asked the kind of questions that undermined the conventional wisdom and led economists to look at their subject matter with new eyes. Once you see economics as about exchange and the institutions that frame it, as Buchanan does, you never see it the same way again.

Geoffrey Brennan has given us a very comprehensive once-over-lightly treatment of the breadth of James Buchanan’s contributions. In reading it, I was struck again by that very breadth and how Buchanan was a major figure in several fundamental areas in economics. One of the great joys of reading his work is that, perhaps more than any other 20th century economist aside from F. A. Hayek, Buchanan asked questions that penetrated to the core of economics as a discipline. He was a master at stepping back from the conversation and asking us all to consider what it all meant and whether we were even talking about the right thing. His legacy, I believe, will be the ways in which he asked the kind of questions that undermined the conventional wisdom and led economists to look at their subject matter with new eyes. Once you see economics as about exchange and the institutions that frame it, as Buchanan does, you never see it the same way again.One point Brennan raises in several places is Buchanan’s relationship with the Austrians, specifically with respect to their contribution to the debate over the feasibility of rational calculation under socialism. Starting with Ludwig von Mises’s 1920 paper [“Economic Calculation in the Socialist Commonwealth”] and 1922 book [Socialism], and extending through Hayek’s famous essays in the 1930s and 40s, the Austrians argued that central economic planners would lack the knowledge necessary to allocate resources with any semblance of economic rationality. As Brennan points out, Buchanan accepted this argument, but chose to ask a different question: If political actors did have the knowledge necessary, would they have the incentives to act on that knowledge in the right way? It is worth noting that one can view the Austrian contribution as asking the inverse question: Even if planners’ incentives are properly aligned, can they acquire the knowledge to do the right thing that they really wish to do?

Buchanan and the Austrians were looking at the same big questions in political economy from opposite sides of the street. I think this is not accidental. What they all shared was a dissatisfaction with the ways in which the emerging neoclassical mainstream of the interwar and postwar years was thinking about these issues. As formalism and technique began to squeeze out economic intuition and decades of accumulated knowledge about the operation of markets and politics, the discipline began to lose sight of how real-world institutions actually worked. Increasingly committed to a formalism that had no role for uncertainty and imperfect knowledge, economics lost its ability to understand perhaps the most fundamental question in the social sciences: How do we achieve social cooperation and coordination in a world of anonymous, self-regarding, and epistemically limited actors? The institutions of the market and politics had become black boxes that economic understanding could not penetrate.

What the Austrians and Buchanan did was break open the black boxes of the market and politics respectively and reveal their inner workings, which contrasted with the official models of the discipline. For the Austrians, Mises’s work on economic calculation and then Hayek’s work on the role of knowledge in the market process both challenged the emerging equilibrium-oriented formalism that was increasingly unable to understand how market institutions facilitated the use of knowledge through the price system, which in turn generated economic coordination among anonymous actors. Rather than the perfectly informed agents maximizing known preferences against known constraints using given prices of general equilibrium analysis, the Austrians saw the market as a process through which actors with epistemic limits engaged in social learning. This is the key lesson of Hayek’s series of knowledge papers in the 1930s and ’40s.

One important implication of this work is that it revealed markets as “imperfect” in comparison to perfectly competitive general equilibrium. The Austrian argument was never that markets solved every problem ideally, only that they did so better than a world in which they were absent. This point mattered because it was half of what would become a two-part challenge to the theory of “market failure” that was beginning to emerge. Developed in the same period as the Austrian work, but arguably codified after World War II in Paul Samuelson’s Principles, this view argued that any way in which markets failed to live up to the perfectly competitive ideal was defined as a “market failure,” with the presumption that it could be remedied by appropriately designed government intervention. Market failure, by this definition, was omnipresent. What the Austrian argued was that the comparison to the perfectly competitive ideal was misguided: It relied on a view of human agency and knowledge that was at odds with the reality of human action and therefore presented a conception of “markets” that bore no relationship to the actual institutions of the market.

The other half of this challenge came from Buchanan. Just as the Austrians had broken open the black box of the market to challenge the blackboard models of midcentury economists, Buchanan and the Public Choice tradition broke open the black box of politics to challenge the blackboard models of the state held by economists, political scientists, and others. For Buchanan, even if markets “failed,” the question was whether the blackboard models of government intervention could work as promised. For example, pollution was often seen as a “market failure” caused by polluters imposing costs on third parties, rather than bearing them directly, which implied that they were producing more pollution than was optimal. The correction would be for governments to tax the polluters an amount that matched the social cost of the pollution, thereby discouraging their behavior and providing the revenue needed to compensate those harmed by the pollution. On the blackboard, this solution would bring about the efficient result the market could not achieve.

What Buchanan did was to point out that the problem with the “market failure implies political remedy” formula is that these models invoked a “behavioral asymmetry” about market and political actors. In the perfect-competition model, actors were assumed to be motivated by their self-interest in their response to costs and benefits. By contrast political actors were never modeled as thinking about their self-interest; they simply did what the blackboard models said they should do in the public interest. No one ever asked whether doing what economists said “should” be done was actually in the interest of political actors. To be precise, Buchanan’s contribution here was not to say that politicians are self-interested, but to simply demand that we treat economic and political actors symmetrically. That is, doing political economy responsibly means making the same assumptions about the motivations of political actors as economic ones. This is what Buchanan means by saying that we need “politics without romance.”

Breaking open the black box of politics meant that politics too now had to be seen as the realm of self-interested exchange. With voters, politicians, and bureaucrats all behaving in broadly self-interested ways in response to incentives, the idea that governments would do what economic models said they should was forever changed from an assumption to a question. Just as the Austrians pointed out that real-world markets are about the strivings of epistemically limited actors engaging in exchange rather than maximization, Buchanan pointed out that real-world political institutions are about self-interested actors engaging in exchange rather than automatically serving the public interest.

Breaking open these black boxes gives us a truly comparative political economy. With neither markets nor politics able to function like the blackboard ideal, we are forced to actually compare how each system works in its imperfect reality. This is where Buchanan’s emphasis on “rules of the game” moves to the forefront. A political economy that asks how well different sets of rules will function when the game is played by actors who are both epistemically limited and broadly self-interested will be, in Mark Pennington’s (2011) term, “robust” with regard to assumptions about human action and motivation. Sets of rules that generate wealth-increasing and coordination-enhancing exchanges even when knowledge is limited and knavery is afoot will be ones that we will want to adopt if we care about human progress.

Buchanan’s constitutionalism, which parallels many of the ideas in Hayek’s later work, such as The Constitution of Liberty (1960), is the natural resting place for both Public Choice theorists and Austrians. What modern Austrian economics can bring to Buchanan’s work is the question of whether constitutional rules must, as he believed, be imposed exogenously. As Brennan notes, Buchanan did not believe that market processes could generate all of their own rules. Rules that prevented destructive self-interest or channeled it into productive uses had to be the product of political deliberation. A younger generation of scholars in the Austrian tradition is challenging that view. Although they largely accept Buchanan’s analysis of the problems of politics, they are exploring whether markets and other nonpolitical processes can endogenously generate rules and norms that lead to effective self-governance in the absence of the state. They too are doing “constitutional political economy,” but the word “constitutional” refers not to a literal constitution, but to our ability to generate self-enforcing norms of that sort. Buchanan himself was indeed skeptical of the possibility of a stateless society, but his work, like Hayek’s, might point in a more radical direction.

Copyright and Fair Use Statement

“Liberty Matters” is the copyright of Liberty Fund, Inc. This material is put on line to further the educational goals of Liberty Fund, Inc. These essays and responses may be quoted and otherwise used under “fair use” provisions for educational and academic purposes. To reprint these essays in course booklets requires the prior permission of Liberty Fund, Inc. Please contact oll@libertyfund.org if you have any questions.