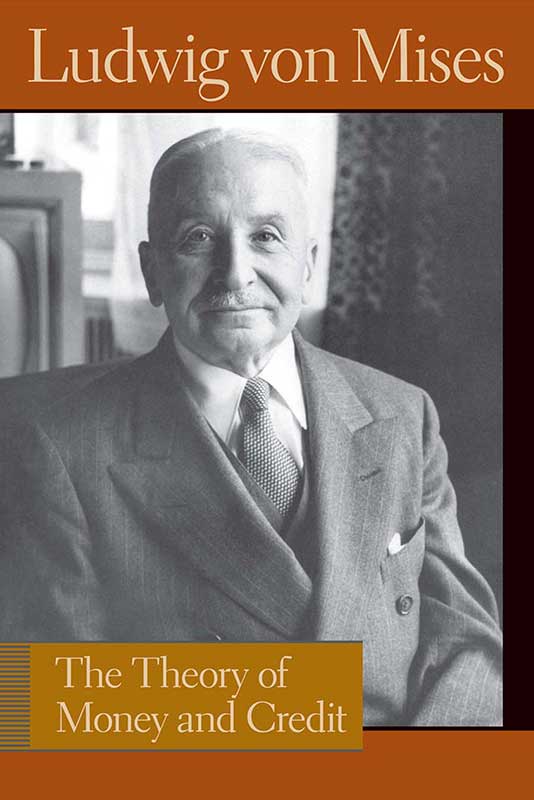

The Theory of Money and Credit

- Ludwig von Mises (author)

- Harold E. Batson (translator)

The Theory of Money and Credit opened new economic vistas. It integrated monetary theory into the main body of economic analysis for the first time, providing fresh new insights into the nature of money and its role in the economy. As the well-known economist Murray Rothbard writes in his new foreword: “This book performed the mighty feat of integrating monetary with micro theory, of building monetary theory upon the individualistic foundations of general economic analysis.”

Related People

Key Quotes

Money & Banking

Money & Banking

Money & Banking

Money & Banking

Critical Responses

Book

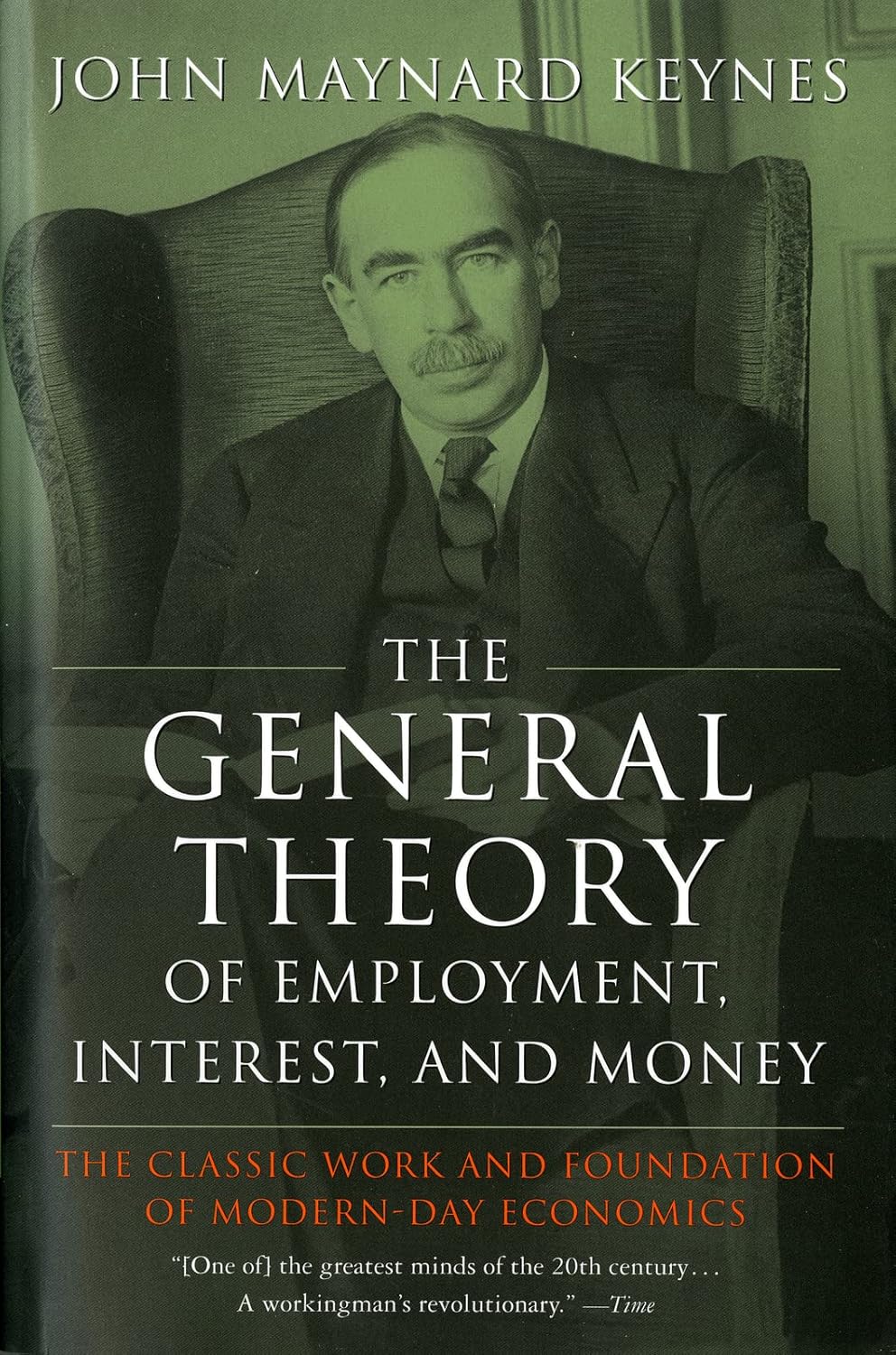

The General Theory of Employment, Interest, and MoneyJohn Maynard Keynes

While not aimed specifically at Mises, it provides a complete alternative framework for interest rates, money, and business cycles. It serves as the foundational theoretical rejection of Austrian explanations of depressions.

Book

A Monetary History of the United StatesMilton Friedman and Anna Schwartz

Friedman and Schwartz offer an empirical, data-driven approach that challenges Austrian cycle theory. They argue that depressions and inflations are caused primarily by central bank mismanagement, not credit-induced capital distortions.

Connected Readings

Book

On the Manipulation of Money and Credit: Three Treatises on Trade-Cycle TheoryLudwig von Mises

Monetary Stabilization and Cyclical Policy

Book

Planning for Freedom: Let the Market System Work. A Collection of Essays and AddressesLudwig von Mises