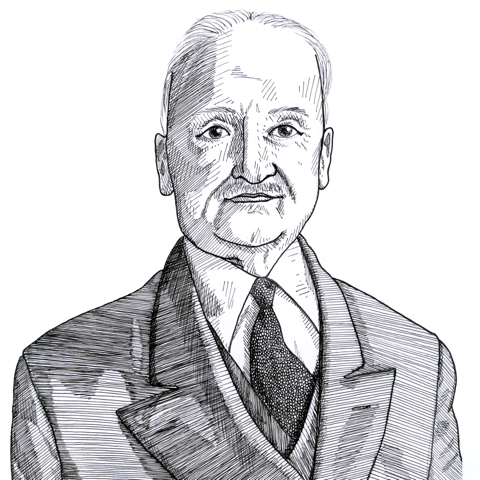

Ludwig von Mises shows the inevitability of economic slumps after a period of credit expansion (1951)

Found in: Economic Freedom and Interventionism

In the article "Inflation Must End in a Slump," written in 1951, the Austrian economist Ludwig von Mises (1881-1973) noted that all periods of government induced credit expansion must end in an economic crisis.

Money & Banking

This country, and with it most of the Western world, is presently going through a period of inflation and credit expansion. As the quantity of money in circulation and deposits subject to check increases, there prevails a general tendency for the prices of commodities and services to rise. Business is booming.

Yet such a boom, artificially engineered by monetary and credit expansion, cannot last forever. It must come to an end sooner or later. For paper money and bank deposits are not a proper substitute for nonexisting capital goods. Economic theory has demonstrated in an irrefutable way that a prosperity created by an expansionist monetary and credit policy is illusory and must end in a slump, an economic crisis. It has happened again and again in the past, and it will happen in the future, too.