Mises on the State Theory of Money (1912)

Found in: The Theory of Money and Credit

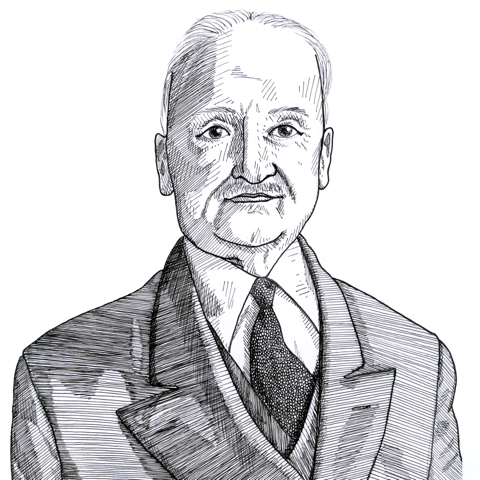

In his path-breaking book The Theory of Money and Credit (1912) the Austrian economist Ludwig von Mises (1881-1973) contrasts two very different ways by which money gets its value - either by “the command of the state”, or “on the estimation of commerce”:

Money & Banking

Another acatallactic doctrine seeks to explain the value of money by the command of the state. According to this theory the value of money rests on the authority of the highest civil power, not on the estimation of commerce. The law commands, the subject obeys. This doctrine can in no way be fitted into a theory of exchange; for apparently it would have a meaning only if the state fixed the actual level of the money prices of all economic goods and services as by means of general price regulation. Since this cannot be asserted to be the case, the state theory of money is obliged to limit itself to the thesis that the state command establishes only the Geltung or validity of the money in nominal units, but not the validity of these nominal units in commerce.