Ludwig von Mises lays out five fundamental truths of monetary expansion (1949)

Found in: Human Action: A Treatise on Economics, vol. 2 (LF ed.)

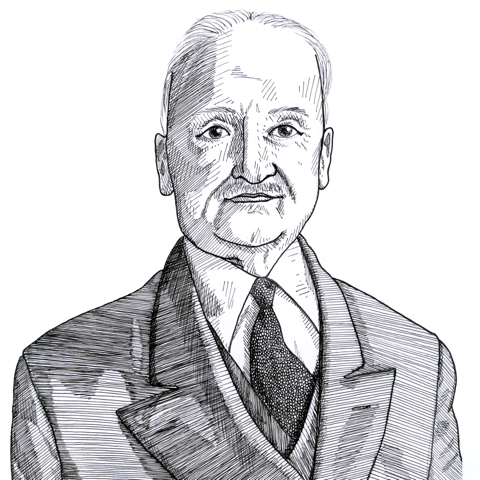

The Austrian economist Ludwig von Mises (1881-1973), in the chapter "The Inflationist View of History" in his masterwork Human Action (1949), criticises the popular view that a policy of inflation (or a general rise in prices of all goods and services) is good for economic development

Money & Banking

Economics recommends neither inflationary nor deflationary policy. It does not urge the governments to tamper with the market’s choice of a medium of exchange. It establishes only the following truths:

By committing itself to an inflationary or deflationary policy a government does not promote the public welfare, the commonweal, or the interests of the whole nation. It merely favors one or several groups of the population at the expense of other groups.

It is impossible to know in advance which group will be favored by a definite inflationary or deflationary measure and to what extent. These effects depend on the whole complex of the market data involved. They also depend largely on the speed of the inflationary or deflationary movements and may be completely reversed with the progress of these movements.

At any rate, a monetary expansion results in misinvestment of capital and overconsumption. It leaves the nation as a whole poorer, not richer. These problems are dealt with in Chapter 20.

Continued inflation must finally end in the crack-up boom, the complete breakdown of the currency system.

Deflationary policy is costly for the treasury and unpopular with the masses. But inflationary policy is a boon for the treasury and very popular with the ignorant. Practically, the danger of deflation is but slight and the danger of inflation tremendous.