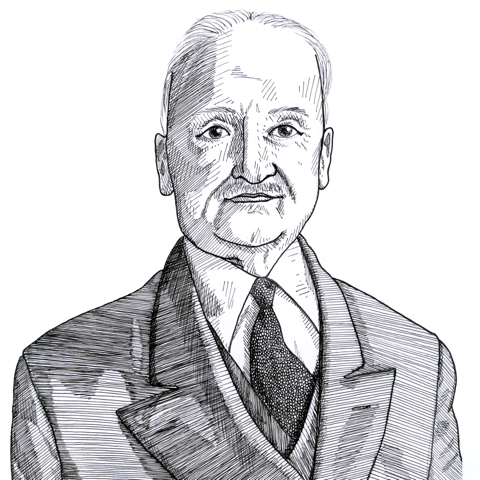

Ludwig von Mises identifies the source of the disruption of the world monetary order as the failed policies of governments and their central banks (1934)

Found in: The Theory of Money and Credit

In 1952, the Austrian economist, Ludwig von Mises (1881-1973) argued that the disruption of the world monetary order was attributable to the policies of governments and their central banks:

Money & Banking

The people of all countries agree that the present state of monetary affairs is unsatisfactory and that a change is highly desirable… The destruction of the monetary order was the result of deliberate actions on the part of various governments. The government-controlled central banks and, in the United States, the government-controlled Federal Reserve System were the instruments applied in this process of disorganization and demolition. Yet without exception all drafts for an improvement of currency systems assign to the governments unrestricted supremacy in matters of currency and design fantastic images of superprivileged superbanks… The inanity of all these plans is not accidental. It is the logical outcome of the social philosophy of their authors.