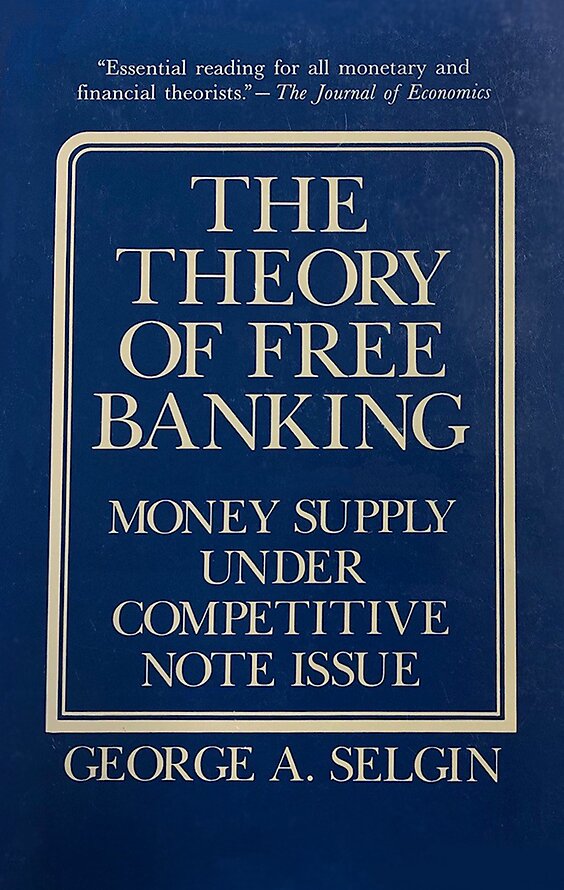

The Theory of Free Banking: Money Supply under Competitive Note Issue

- George A. Selgin (author)

- Lawrence H. White (foreword)

This is a defense of the theory and practice of free banking, i.e. the competitive issue of money by private banks as opposed to the centralised and monopolised issuance of currency under a system of central banking.

Related People

Critical Responses

Journal Article

Unanswered Quibbles with Fractional Reserve Free BankingPhillip Bagus and David Howden

This critique is foundational for contemporary debates opposing Selgin’s arguments—making it essential reading for those exploring contrasting views within free banking scholarship.

Journal Article

Free Banking and the Free BankersJörg Guido Hülsmann

Hülsmann offers a broader critique by arguing that certain defenders of free banking—including Selgin, White, and others—have inadvertently weakened the case for truly “authentic” free banking. He suggests that some defenders inadvertently adopt flawed arguments or obscure key theoretical issues,…

Connected Readings