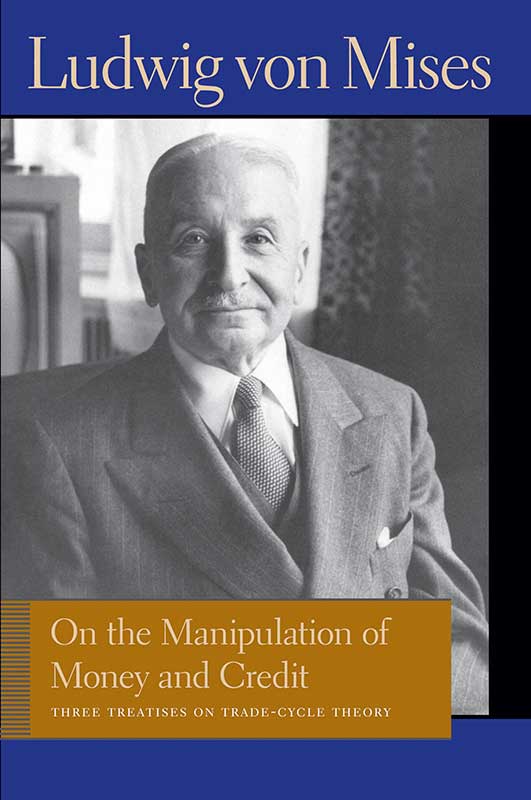

On the Manipulation of Money and Credit: Three Treatises on Trade-Cycle Theory

- Ludwig von Mises (author)

- Percy L. Greaves, Jr. (editor)

- Bettina Bien Greaves (introduction)

On the Manipulation of Money and Credit includes some of Mises’s most important contributions to monetary and trade-cycle theories. “Stabilization of the Monetary Unit from the Viewpoint of Theory,” discusses the consequences of the fluctuating purchasing power of paper money. “Monetary Stabilization and Cyclical Policy” presents Mises’s business-cycle theory. “The Causes of the Economic Crisis,” explores the nature and role of the market and cyclical changes in business conditions.

Related People

Key Quotes

Money & Banking

Critical Responses

Book

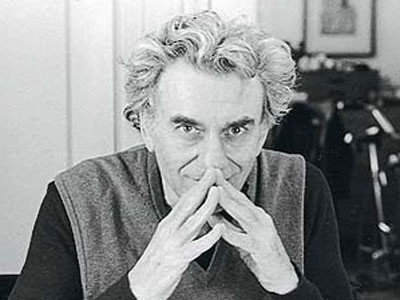

Stabilizing an Unstable EconomyHyman Minsky

Hyman Minsky in his 1986 “Stabilizing an Unstable Economy” offers his hypothesis in order to explain business cycles, one, however, that leads to different prescriptions than Mises’ one.

Connected Readings

Book

Ludwig von Mises, Money, and the Fall and Rise of Classical Liberalism in the 20th CenturyLiterature of Liberty Editor

Podcast

Peter Boettke on the Austrian Perspective on Business Cycles and Monetary PolicyPeter Boettke and Russ Roberts

EconTalk