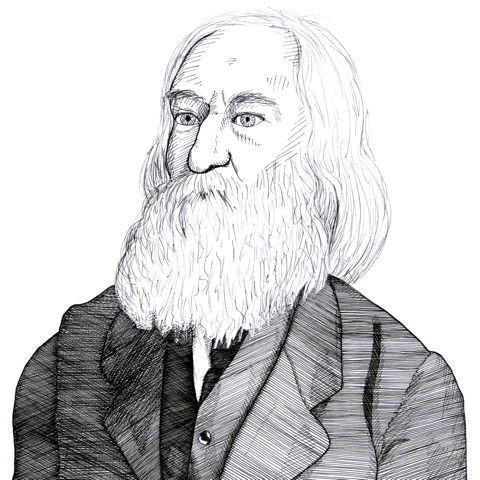

Lysander Spooner argues that according to the traditional English common law, taxation would not be upheld because no explicit consent was given by individuals to be taxed (1852)

Found in: An Essay on the Trial by Jury (1852)

One of the demands of the American revolutionaries was “no taxation without representation”; Spooner takes this demand one step further by stating “no taxation without explicit consent”:

Taxation

If the trial by jury were reëstablished, the Common Law principle of taxation would be reëstablished with it; for it is not to be supposed that juries would enforce a tax upon an individual which he had never agreed to pay. Taxation without consent is as plainly robbery, when enforced against one man, as when enforced against millions; and it is not to be imagined that juries could be blind to so self-evident a principle. Taking a man’s money without his consent, is also as much robbery, when it is done by millions of men, acting in concert, and calling themselves a government, as when it is done by a single individual, acting on his own responsibility, and calling himself a highwayman. Neither the numbers engaged in the act, nor the different characters they assume as a cover for the act, alter the nature of the act itself.