Jefferson tells Congress that since tax revenues are increasing faster than population then taxes on all manner of items can be “dispensed with” (i.e. abolished) (1801)

Found in: The Works, vol. 9 (1799-1803)

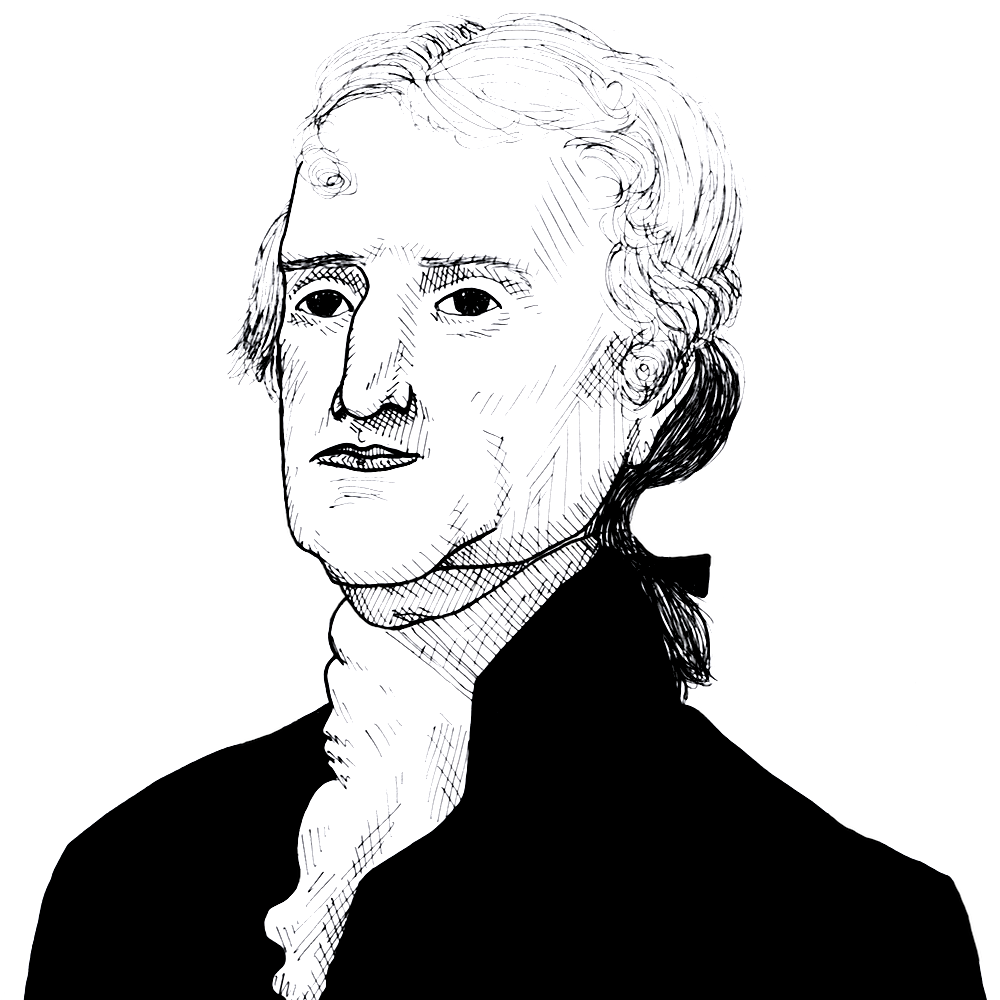

In his first annual message to Congress in 1801, President Thomas Jefferson (1743-1826) discussed how the tax burden could be reduced and warned how "accumulated treasure" could tempt regimes to go to war in the future:

Taxation

War, indeed, and untoward events, may change this prospect of things, and call for expenses which the imposts could not meet; but sound principles will not justify our taxing the industry of our fellow citizens to accumulate treasure for wars to happen we know not when, and which might not perhaps happen but from the temptations offered by that treasure. These views, however, of reducing our burdens, are formed on the expectation that a sensible, and at the same time a salutary reduction, may take place in our habitual expenditures. For this purpose, those of the civil government, the army, and navy, will need revisal.