Destutt de Tracy on the damage which government debt and the class which lives off loans to the state cause the industrious classes (1817)

Found in: A Treatise On Political Economy

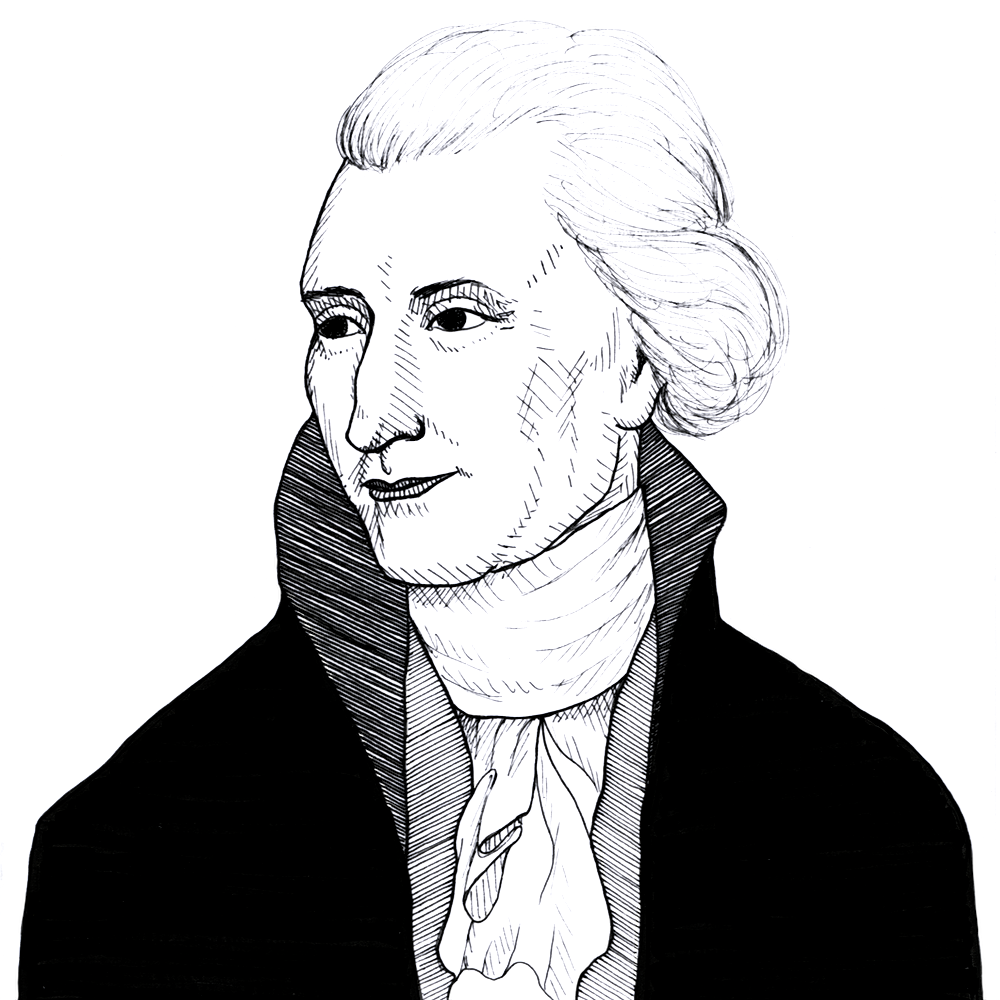

The Idéologue and classical liberal Destutt de Tracy (1754-1836) criticised the practice of increasing government debt by “borrowing money on perpetual annuities” as harmful to productive economic activity and which perpetuated the power of “a crowd of useless annuitants” who live off future taxes:

Economics

It is then as erroneous to believe that the loans of government are not hurtful to national industry, as it is to suppose that the funds which they produce, are not taken from any individual involuntarily. In truth these are not the real reasons which cause so much importance to be attached to the possibility of borrowing. The great advantage of loans, in the eyes of their partisans, is that they furnish in a moment enormous sums, which could only have been very slowly procured by means of taxes, even the most overwhelming. Now I do not hesitate to declare that I regard this pretended advantage as the greatest of all evils.