David Ricardo on the “mere increase of money” (1809)

Found in: The Works and Correspondence of David Ricardo, Vol. 3 Pamphlets and Papers 1809-1811

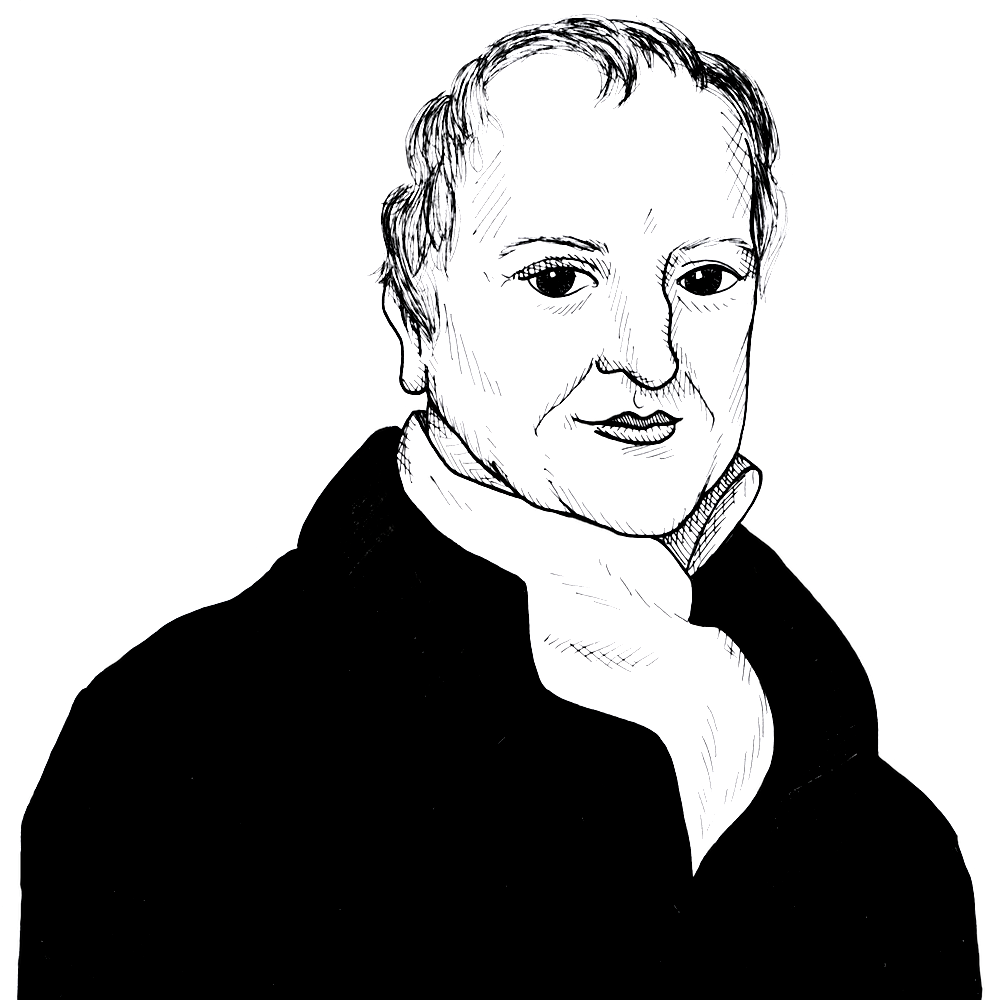

After Britain went off the gold standard so it could increase funding the war against Napoleon, the English economist David Ricardo (1772-1823) argued that the general increase in prices was a direct result of this policy and, in a series of articles which appeared in 1809, asked “Why should the mere increase of money have any other effect than to lower its value?”:

Money & Banking

Why should the mere increase of money have any other effect than to lower its value? How would it cause any increase in the production of commodities?

This is true taking all commodities together, —but fashion or other causes may create an increased demand for one article and consequently the demand for some one or more of others must diminish. Will not this operate on prices?…

In this conclusion I perfectly agree if the author means the mass of prices, but a hundred articles might have risen, whilst another hundred might have fallen in consequence of increased or decreased demand, increased or decreased knowledge in the best means of producing them. Nay the mass of prices might remain the same tho’ each individual article had risen in consequence of taxation.

Money cannot call forth goods, —but goods can call forth money…