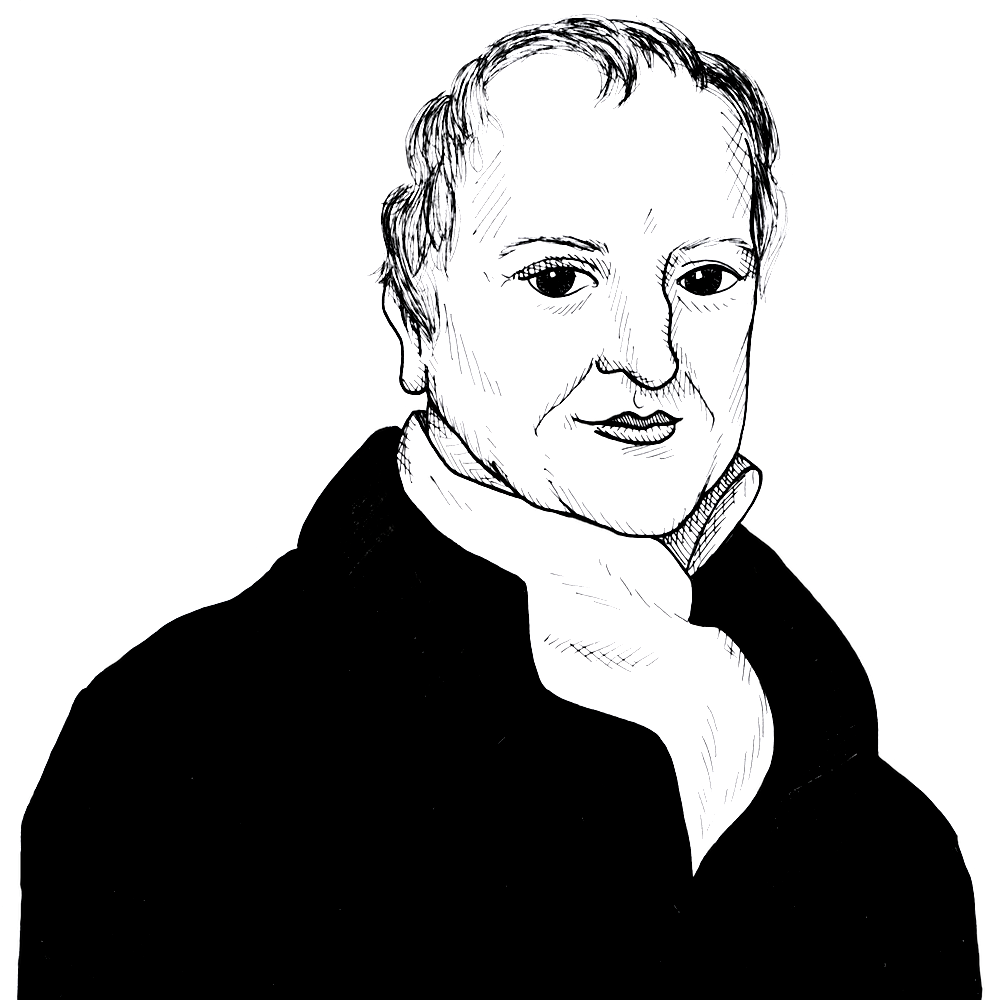

David Ricardo on Taxation

Found in: The Works of David Ricardo (McCulloch ed. 1846, 1888)

In this brief passage, Ricardo discusses some basic principles of taxation. First, he acknowledges that taxation will always reduce the disposable income of the economic agents to be taxed; there is no way around that.

Economics

Taxation under every form presents but a choice of evils; if it do not act on profit, or other sources of income, it must act on expenditure; and provided the burthen be equally borne, and do not repress reproduction, it is indifferent on which it is laid. Taxes on production, or on the profits of stock, whether applied immediately to profits, or indirectly, by taxing the land or its produce, have this advantage over other taxes; that, provided all other income be taxed, no class of the community can escape them, and each contributes according to his means. (FROM CHAPTER IX.: TAXES ON RAW PRODUCE)