Adam Smith, Employment, and the Advantages to Society

Found in: An Inquiry Into the Nature and Causes of the Wealth of Nations (Cannan ed.), vol. 2

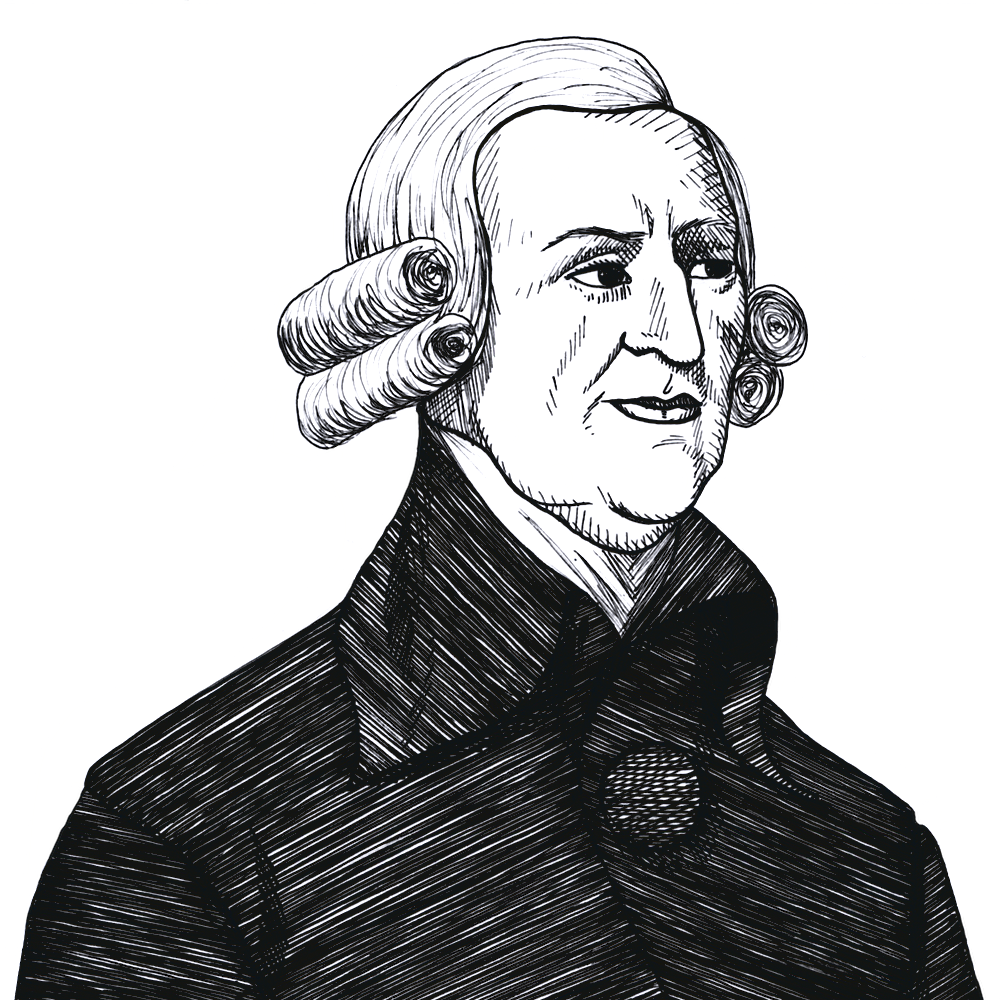

The Scottish moral philosopher Adam Smith (1723–1790) was the author of two books, The Theory of Moral Sentiments (1759) and An Inquiry into the Nature and Causes of the Wealth of Nations (1776).

In his discussion “Of Restraints upon the importation from Foreign Countries of such Goods as can be produced at Home”, Smith writes the following passage:

Economics

Every individual is continually exerting himself to find out the most advantageous employment for whatever capital he can command. It is his own advantage, indeed, and not that of the society, which he has in view. But the study of his own advantage naturally, or rather necessarily leads him to prefer that employment which is most advantageous to the society. (IV.2.4)