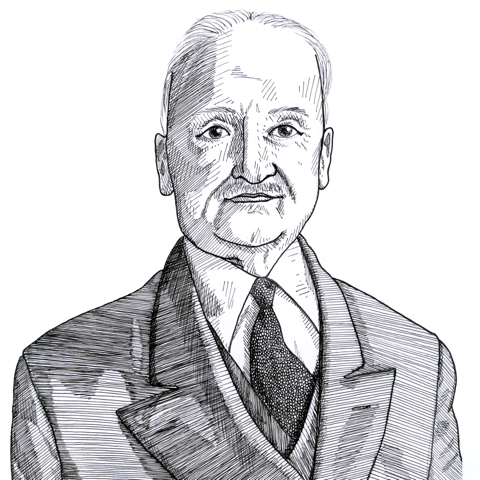

Mises on the public sector as “tax eaters” who “feast” on the assets of the ordinary tax payer (1953)

Found in: Economic Freedom and Interventionism

In a similar fashion to John C. Calhoun’s division of the world into net “tax-consumers” and net “tax-payers”, the Austrian economist Ludwig von Mises (1881-1973) distinguished between the ordinary citizens who paid taxes and the public sector entities like the New York subway which “consumed” the taxes paid by the former. This is a classic example of what Mises in 1945 termed “the clash of group interests”:

Taxation

The financial embarrassment of the main European countries is predominantly caused by the bankruptcy of the nationalized public utilities. The deficit of these enterprises is incurable. A further rise in their rates would bring about a drop in total net proceeds. The traffic could not bear it. Daily experience proves clearly to everybody but the most bigoted fanatics of socialism that governmental management is inefficient and wasteful. But it is impossible to sell these enterprises back to private capital because the threat of a new expropriation by a later government would deter potential buyers.

In a capitalist country the railroads and the telegraph and telephone companies pay considerable taxes. In the countries of the mixed economy, the yearly losses of these public enterprises are a heavy drain upon the nation’s purse. They are not taxpayers, but tax-eaters.

Under the conditions of today, the nationalized public utilities of Europe are not merely feasting on taxes paid by the citizens of their own country; they are also living at the expense of the American taxpayer. A considerable part of the foreign-aid billions is swallowed by the deficits of Europe’s nationalization experiments…