A Treatise on Metallic and Paper Money and Banks (1858)

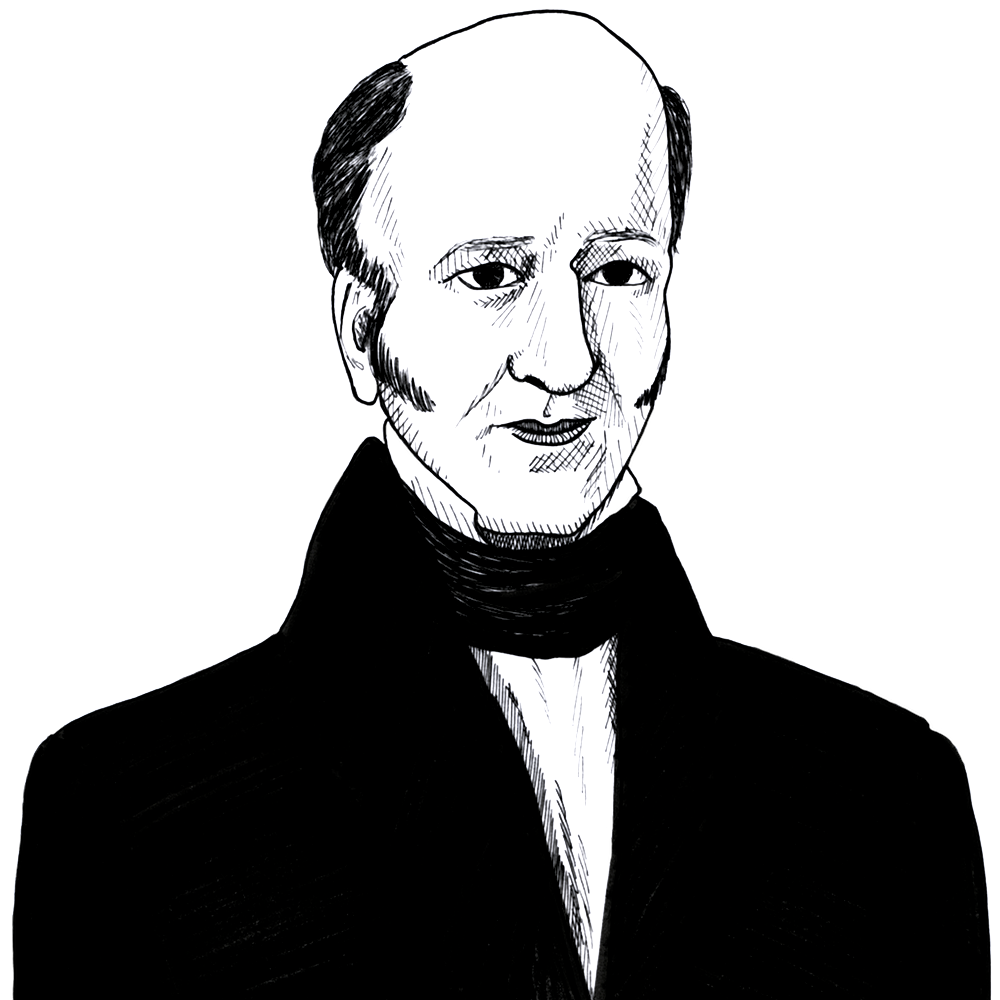

- John Ramsay McCulloch (author)

This is an 80 page encyclopedia article on money and banking which includes a discussion of gold and silver backed money, paper money, private banks, and a brief history of banking in England, France, Scotland, Ireland, and the US.