Part of: A History of Banking in all the Leading Nations, 4 vols. A History of Banking in all the Leading Nations, vol. 1 (U.S.A.)

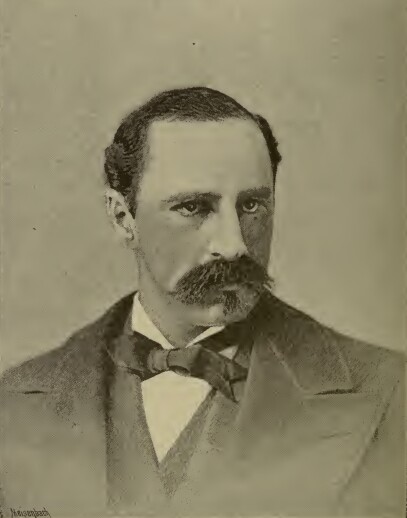

A four volume set edited by the Editor of the Journal of Commerce and Commercial Bulletin in New York. Vol. 1 consists of “The United States,” by W.G. Sumner.

Related People

Critical Responses

Article

American banking and growth in the nineteenth century: A partial view of the terrainRichard Sylla

Prof. Sylla’s perspective on the history of banking in the United States often refers to Sumner’s work, but has a somewhat distinct interpretation.

Connected Readings

Book

On Liberty, Society, and Politics: The Essential Essays of William Graham SumnerWilliam Graham Sumner