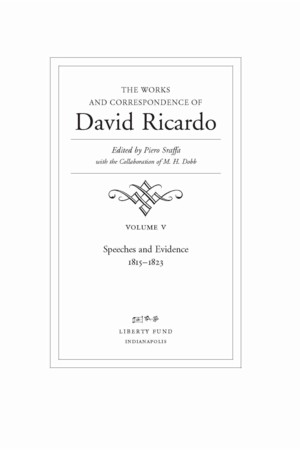

Part of: The Works and Correspondence of David Ricardo, 11 vols (Sraffa ed.) The Works and Correspondence of David Ricardo, Vol. 5 Speeches and Evidence

- Piero Sraffa (editor)

- David Ricardo (author)

Speeches and Evidence contains the texts of Ricardo’s numerous speeches. It consists of his speeches given in the House of Commons and evidentiary advocacies before Parliamentary committees. The introduction provides insightful context to the circumstances and events that preceded Ricardo’s appointment as a Member of Parliament and describes his subsequent influence and role on various committees.

Related People

Key Quotes

Property Rights

Whatever might be his gains after such a principle (of redistribution) had been admitted would be held by a very insecure tenure, and the chance of his making any future gains would be greatly diminished; for the quantity of employment in the country must depend, not only on the quantity of…

Critical Responses

Essay

Economics and Ideology: Aspects of the Post-Ricardian LiteratureSamuel Hollander

A number of criticisms to Ricardo’s central ideas are discussed in this essay.

Essay

Searching for Capitalism in the Wreckage of GlobalizationOren Cass

In this article the author argues that Ricardo’s concept of comparative advantage is not of general application.

Connected Readings