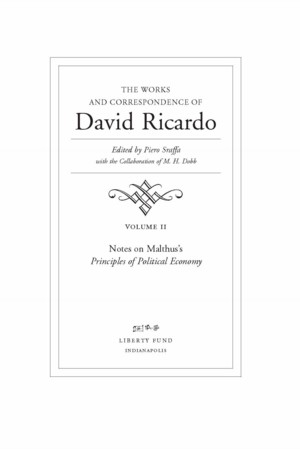

Part of: The Works and Correspondence of David Ricardo, 11 vols (Sraffa ed.) The Works and Correspondence of David Ricardo, Vol. 2 Notes on Malthus

- David Ricardo (author)

- Piero Sraffa (editor)

- Maurice Herbert Dobb (editor)

David Ricardo and T. R. Malthus were friends despite a contentious divergence of opinion on many political economic issues. This volume contains the formal remnants of their differences. Ricardo analyzes, issue-by-issue, his points of divergence to Malthus’s Principles of Political Economy Malthus’s contributions to political economics generally concern his bleak forecast that a geometrically growing population would surpass the arithmetically growing capacity of essential natural resources.

Related People

Critical Responses

Essay

Economics and Ideology: Aspects of the Post-Ricardian LiteratureSamuel Hollander

A number of criticisms to Ricardo’s central ideas are discussed in this essay.

Essay

Searching for Capitalism in the Wreckage of GlobalizationOren Cass

In this article the author argues that Ricardo’s concept of comparative advantage is not of general application.

Connected Readings