Nassau Senior on how the universal acceptance of gold and silver currency creates a world economy (1830)

Found in: Three Lectures on the Cost of Obtaining Money

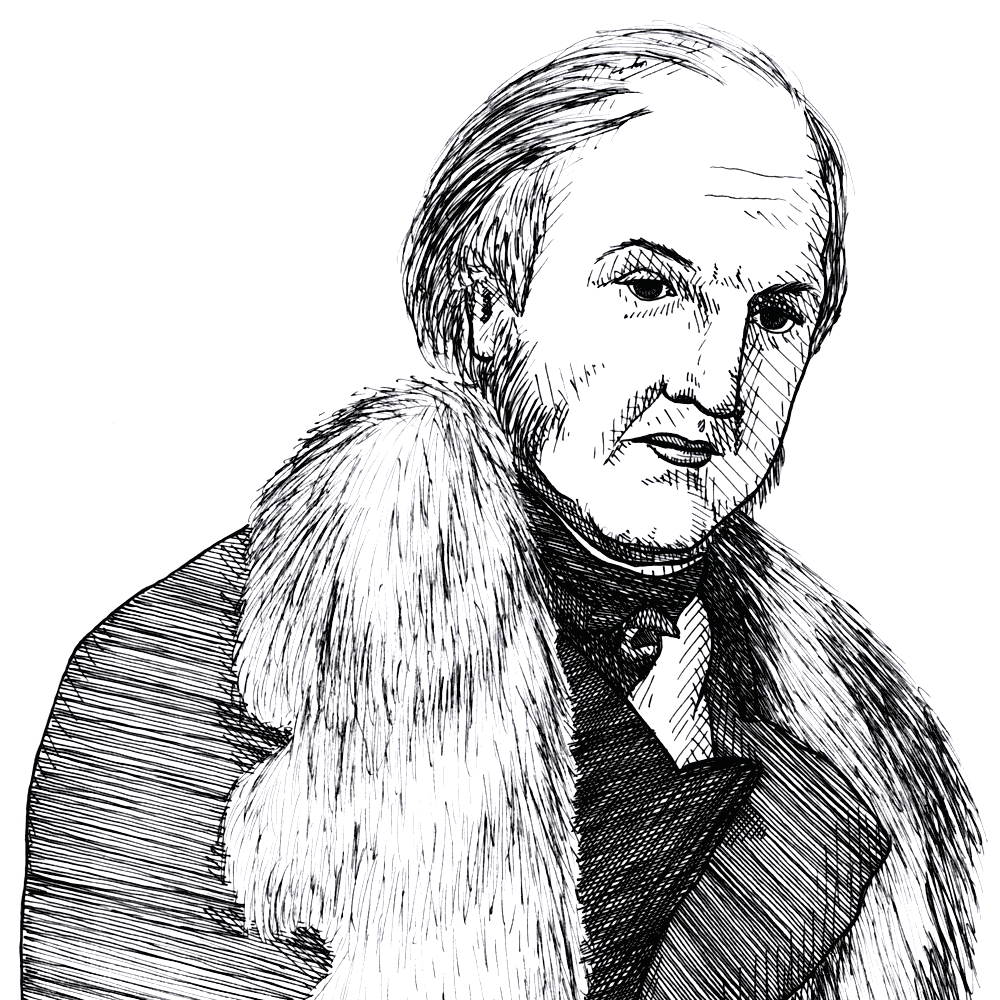

The British classical economist Nassau William Senior (1790-1864) wrote a number of works on both paper money and hard currency in the late 1820s. In this quote he discusses how the portability and widespread acceptance of precious metal currency creates a true global economy:

Money & Banking

In fact the portableness of the precious metals and the universality of the demand for them render the whole commercial world one country, in which bullion is the money and the inhabitants of each nation form a distinct class of labourers. We know that in the small market of every district the remuneration paid to the producer is in proportion to the value produced. And consequently that if one man can by superior diligence, or superior skill, or by the assistance of a larger capital, or by deferring for a longer time his remuneration, or by any advantage natural or acquired, occasion a more valuable product, he will receive a higher reward. It is thus that a lawyer is better paid than a watchmaker, a watchmaker than a weaver, a first-rate than an ordinary workman. And for the same reason in the general market of the world an Englishman is better paid than a Frenchman, a Frenchman than a Pole, and a Pole than a Hindoo.