Ludwig von Mises argues that sound money is an instrument for the protection of civil liberties and a means of limiting government power (1912)

Found in: The Theory of Money and Credit

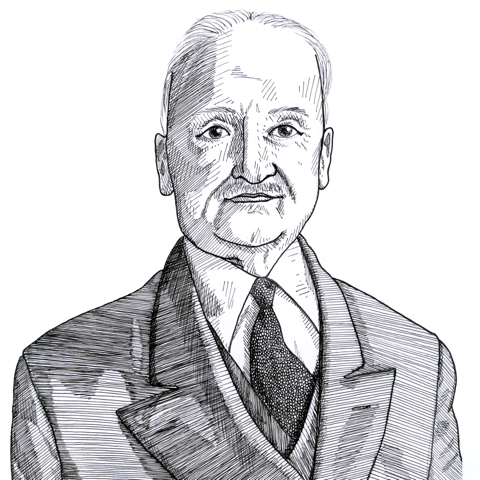

The Austrian economist Ludwig von Mises (1881-1973), argues in The Theory of Money and Credit (1912) that "sound money" was a crucial part of classical liberal theory because it was the market’s choice of a commonly used medium of exchange and also a method for obstructing the government’s propensity to meddle with the currency system:

Money & Banking

The principle of sound money that guided nineteenth-century monetary doctrines and policies was a product of classical political economy. It was an essential part of the liberal program as developed by eighteenth-century social philosophy and propagated in the following century by the most influential political parties of Europe and America…It is impossible to grasp the meaning of the idea of sound money if one does not realize that it was devised as an instrument for the protection of civil liberties against despotic inroads on the part of governments. Ideologically it belongs in the same class with political constitutions and bills of rights. The demand for constitutional guarantees and for bills of rights was a reaction against arbitrary rule and the nonobservance of old customs by kings. The postulate of sound money was first brought up as a response to the princely practice of debasing the coinage. It was later carefully elaborated and perfected in the age which—through the experience of the American continental currency, the paper money of the French Revolution and the British restriction period—had learned what a government can do to a nation’s currency system… Thus the sound-money principle has two aspects. It is affirmative in approving the market’s choice of a commonly used medium of exchange. It is negative in obstructing the government’s propensity to meddle with the currency system.