Response Essay Systemic Racism in Crime: Do Blacks Commit More Crimes Than Whites?

In 2019, Black people made up 12.2% of the U.S. population (U.S. Census Bureau, American Community Survey). Blacks, however, represent 26.6% of total arrests, including 51.2% of murder arrests, 52.7% of robbery arrests, 28.8% of burglary arrests, 28.6% of motor vehicle theft arrests, 42.2% of prostitution arrests, and 26.1% of drug arrests (FBI’s Uniform Crime Report, Table 43).

In 2019, Black people made up 12.2% of the U.S. population (U.S. Census Bureau, American Community Survey). Blacks, however, represent 26.6% of total arrests, including 51.2% of murder arrests, 52.7% of robbery arrests, 28.8% of burglary arrests, 28.6% of motor vehicle theft arrests, 42.2% of prostitution arrests, and 26.1% of drug arrests (FBI’s Uniform Crime Report, Table 43).Black residents also have the highest level of incarceration rates of any racial group. As of 2019, Blacks were incarcerated in local jails at a rate of 600 per 100,000 U.S. residents, which is more than three times the rate for Whites (184 per 100,000 U.S. residents) (Zeng and Minton 2021). The combined state and federal imprisonment rate for Black sentenced prisoners in 2019 was 1,096 per 100,000 U.S. residents compared to 214 per 100,000 U.S. residents for Whites (Carson 2020).

Combined, do these basic data indicate that systemic racism exists in criminal activity?

One interpretation of the data is that Black people commit more crimes relative to those of other races; thus, they are arrested and sentenced to prison at higher rates. Let’s run with this possibility. (An alternative argument to explain the data is that there is systemic racism at the point of arrests and sentencing. For the sake of brevity and to focus on commission of crimes, we will pause this explanation).

Why does any individual commit a crime? Since Gary Becker’s (1968) seminal paper, criminal activity is viewed as a choice. Criminal activity is analyzed like any other economic activity – as a rational choice within an individual’s constraints. Criminals are rational actors comparing costs and benefits of legal versus illegal activities to achieve their goals, including maximizing income, social status, and psychic reward. As Becker states, “some individuals become criminals because of the financial and other rewards from crime compared to legal work, taking account of the likelihood of apprehension and conviction, and the severity of punishment” (p. 176).

If we take Becker’s rational choice approach to crime, the question becomes why would Black individuals choose to commit more crimes relative to their non-Black counterparts? If they are committing relatively more crimes, they must have a rational reason to do so. This suggests that individuals face constraints that incentivize criminal behavior that differ along racial margins. In other words, the costs and benefits for criminal activity are different for Blacks versus Whites. But why?

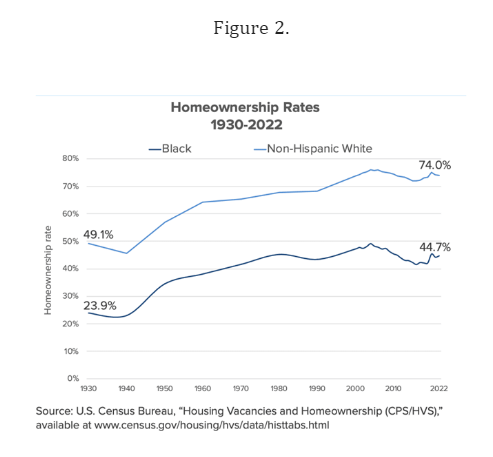

A large literature suggests that economic determinants of crime include educational attainment, income, poverty level, and employment status (Buonanno 2003; Cerulli et al. 2018). Racial gaps in poverty, education, income, and employment exist and have persisted for several decades. For example, in 2019 the poverty rate (Semega et al. 2020) and unemployment rate (BLS Reports 2020) for Blacks was roughly two times the poverty and unemployment rates of non-Hispanic Whites. Forty percent of White adults hold a bachelor’s degree compared to 26% of Blacks (Harris 2022). Educational disparities lead to pronounced differences in economic security across racial groups.

Black Americans are possibly committing relatively more crimes because of facing higher economic insecurities and limited economic opportunities. This is plausible. If it is more difficult for a Black man or woman to obtain legal work and income, engaging in illegal activity (robbery, theft, burglary, prostitution, drug violations, for example) becomes a lower cost alternative. However, this explanation simply pushes the analysis one step back – if it is economic disparity that alters the relative payoff for criminal activity, what are the root causes of economic inequality between Blacks and non-Blacks? What are the barriers preventing Blacks from participating fully in legal work, obtaining higher levels of education, getting higher paying jobs, and rising out of poverty?

Decades of government spending, including transfer payments based on income, has attempted to address racial income, wage, and educational inequalities. In 2022, the total welfare spending on a family of four in poverty was $128,122, yet the poverty line for the same family was $29,950 (Federal Safety Net). Not only is the welfare system broken, but we also must consider that the system creates perverse incentives, namely creating dependency and discouraging work. Additional barriers to economic opportunities arise from government policies despite those policies' stated intention of helping the poor, including poor Blacks. This includes minimum wage laws, affirmative action, occupational licensing, and school choice programs (or lack thereof), to name a few.

Many of these policies create barriers instead of opportunities. For example, occupational licensing, the necessary legal steps and payments to obtain a government required license to practice a specified profession, creates hurdles to work legally. Occupational licensing creates barriers to entry, reducing competition and limiting job options without evidence of an increase in public safety or product quality. It creates unnecessary time and financial burden since the process can involve financial payment, educational requirements, and fees for exams.

Occupational licensing exacerbates economic inequality as it puts additional burdens on those that are economically disadvantaged. As such, it is more difficult for low-income individuals to obtain legal work. At the margin, it could push an individual into criminal activity as the relative price to do so is lower when facing the costs of obtaining a legal license to work.

Another potential barrier to economic opportunity is access to credit. Starting a business requires capital and resources. Limited access to funding can hinder Black entrepreneurs from establishing successful ventures. Black business owners make up only 4.3% of total business owners in this country. Blacks, on average, have lower credit scores compared to Whites, 677 versus 734, respectively, and are less likely to use conventional financial institutions (Broady et al. 2021).

One possible source of lack of access to credit is burdensome financial regulation preventing lenders from being willing to serve a riskier population. Regulation raises the cost of capital and banking practices. Similar to how minimum wage laws cause unemployment among the lower skilled, banking regulations raise the price of serving low-income and marginalized communities. Thus, banks may not find it feasible to lend to riskier borrowers, decreasing the ability of low-income individuals to obtain legal access to banking and credit.

Supporting this argument, Bolen et al. (2023) demonstrate that a 36% APR interest rate cap in Illinois decreased the number of loans to subprime borrowers by 38%. This finding has national level implications as lawmakers continue to propose interest rate cap legislation, which would further limit access to credit to those with poor credit scores and amplify existing economic disparities.

Lack of economic opportunities helps explain the benefit of engaging in criminal activity, but what about the expected costs of getting caught? Interestingly, Dill et al. (2010) casts doubt on government-based deterrence of crime variables such as arrest rates, incarceration rates, police size, and capital punishment, empirically showing that standard deterrence variables do not reduce crime. Instead, the authors find that crime arises in part due to government prohibition policies that affect legal dispute resolution.

This essay spoke in broad racial categories as a means of comparison. However, there is diversity within racial and ethnic groups that do not accurately portray all individuals in those categories. Individuals along all racial lines move in and out of poverty over their lifetimes. Generalizations can be helpful to frame social questions; however, analysis is best done at the individual level, understanding the incentives faced by an individual and considering his or her own preferences, values, and perceptions of costs and benefits.

Back to the original question: do Black individuals commit more crimes explaining the relatively higher arrest and incarceration rates? Maybe. But the real issue is government-created barriers to education, employment and other opportunities that lower the relative price of committing a crime.

**************

References

Becker, G.S., 1968. Crime and punishment: An economic approach. Journal of political economy, 76(2), pp.169-217.

Bolen, J.B., Elliehausen, G. and Miller Jr, T.W., 2023. Credit for me but not for thee: the effects of the Illinois rate cap. Public Choice, 197: 397-420.

Broady, K., McComas, M. and Ouazad, A., 2021. An analysis of financial institutions in Black-majority communities: Black borrowers and depositors face considerable challenges in accessing banking services. Brookings Institute: Washington DC.

Buonanno, P., 2003. The socioeconomic determinants of crime. A review of the literature. Working Paper Dipartimento di Economia Politica, Università di Milano Bicocca; 63.

Carson, Ann E. 2020. Prisoners in 2019. U.S. Department of Justice, Office of Justice Programs, Bureau of Justice Statistics.

Cerulli, G., Ventura, M. and Baum, C.F., 2018. The economic determinants of crime: an approach through responsiveness scores. Report, Department of Economics, Boston College.

Dills, A.K., Miron, J.A. and Summers, G., 2010. What do economists know about crime? In The Economics of Crime: Lessons For and From Latin America. Edited by Rafael Di Tella, Sebastian Edwards, and Ernesto Schargrodsky (eds). University of Chicago Press, 2010. Chicago Scholarship Online, 2013. https://doi.org/10.7208/chicago/9780226153766.003.0009.

Federal Bureau of Investigation Uniform Crime Report. 2019. Crime in the United States, Table 43.

Federal Safety Net. Poverty and Spending Over the Years. https://federalsafetynet.com/poverty-and-spending-over-the-years-2/.

Harris, B. 2022. Racial Inequality in the United States. U.S. Department of the Treasury.

Semega, Jessica, Melissa Kollar, Emily A. Shrider, and John F. Creamer. 2020. Income and Poverty in the United States: 2019. Current Population Reports. U.S. Census Bureau.

U.S. Bureau of Labor Statistics, 2020. Labor force characteristics by race and ethnicity, 2019. BLS Report no. 1088.

U.S. Census Bureau. 2019. American Community Survey

Zeng, Zhen and Todd D. Minton. 2021. Jail Inmates in 2019. U.S. Department of Justice, Office of Justice Programs, Bureau of Justice Statistics.